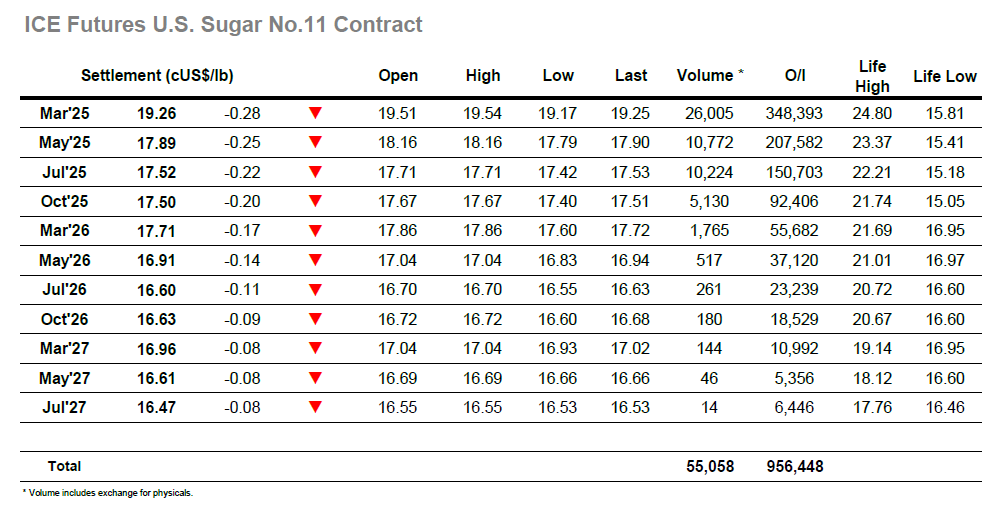

Today, the No.11 market opened at 19.51, down 3 points from the previous day’s settlement. The market had a late opening at 12:30 and initially displayed a rapid upward movement from 19.46 to 19.54 within the first minute , creating the impression of a bullish trend. However, it failed to sustain this momentum and reversed direction, declining over the following minutes to reach the day’s low at 19.17. Shortly after, the market rebounded slightly, stabilizing around the mid-range of 19.30, where it remained until the end of the session. This stability was attributed to lower liquidity during the period between Christmas and New Year holidays. No.11 Mar ’25 closed at 19.26, a decrease of 0.28 cUSD/lb (-1.43%) compared to the previous day’s close. The White premium stood at 93.79, and the H5/K5 spread at 1.37.

Sugar No.5 closed today due to Boxing day Holiday.