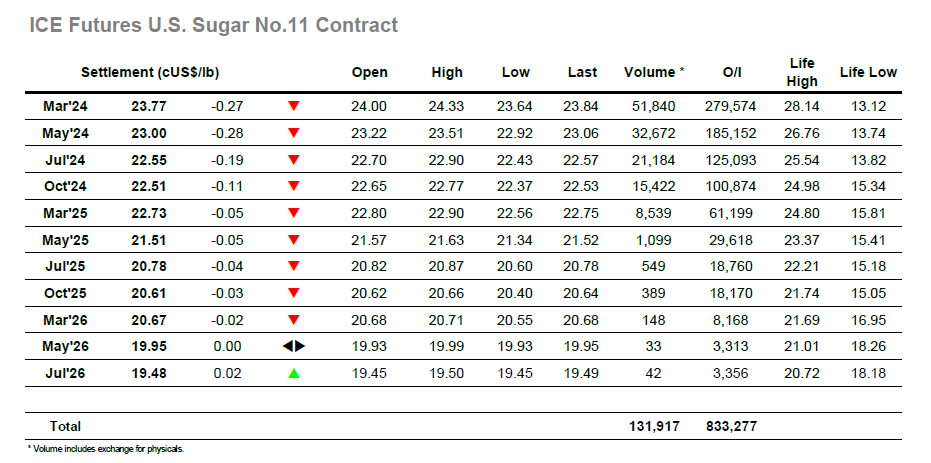

The market was under a modicum of pressure during the early stages and slipped back into the 23.80’s on a couple of occasions, though the light volumes limited the prospect of significant movement. As the morning progressed some light buying returned to bring values back above 24c, and though trading remained quiet the market had a more stable appearance around it with the Americas day approaching. There was a brief spike to 24.33 though that failed to gain any continuation buying, and so with yesterdays pullback still fresh in the memory the market started to retreat once more. On this occasion there was more tangible long liquidation from the smaller specs, reducing their recent longs and sending the price down to 23.71. With little activity being seen away from the specs and algo’s the market continued to chop around the range, recovering to 24.09 before falling back once again, only this time the damage appeared more critical. As the market dropped to 23.64 during the final hour so the nearby spreads felt some damage to give back more of this eeks gain, March/May’24 trading into 0.72 points and March/Jul’24 back to 1.13 points, a sign that the recent higher run may prove tough to resume. There was some MOC buying to ensure a settlement was made a small way above the highs at 23.77, though overall it was a poor way to head into the weekend with this value some 0.85 points below yesterdays high.

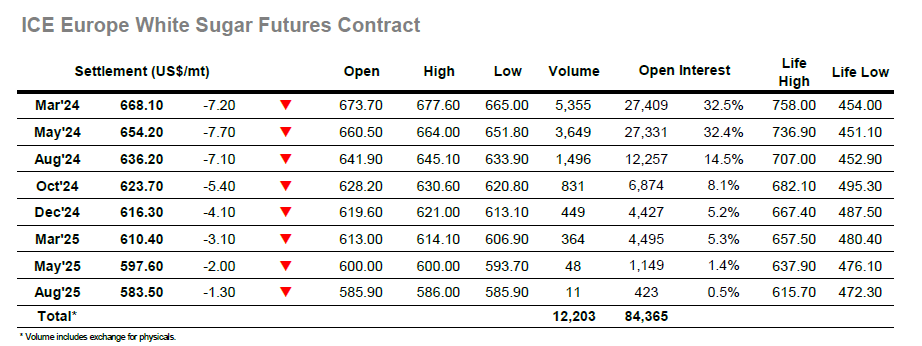

The market appeared to be suffering a hangover from yesterday’s retreat as early trading saw March’24 sitting a couple of dollars beneath unchanged, minor losses but suggesting that the buying interest of the previous few days has now faded. The range remained narrow through the morning, and the lack of buying was impacting the white premium which slipped back further from its recent highs to be trading down towards $141.00. Outright volume was proving very low and so the market was becoming reliant on the specs generating movements through the No.11 market, with the whites hanging on the coattails as the price moved into credit at $677.60 before falling back into the $660’s. Spreads too were seeing lower volumes though with only three weeks until the March’24 expiry there was at least some position rolling taking place, much of it in the $13/$14 area as the differential showed little change. As we reached late afternoon there was a lower desire to try and bring the market back upward and so the picture became defensive as prices instead found a range in the mid/upper $660’s to try and protect against any additional losses. March’24 recorded a session low at $665.00 during this period before encountering MOC buying, though a close at $668.10 is a disappointing way to end the week after what had gone before.