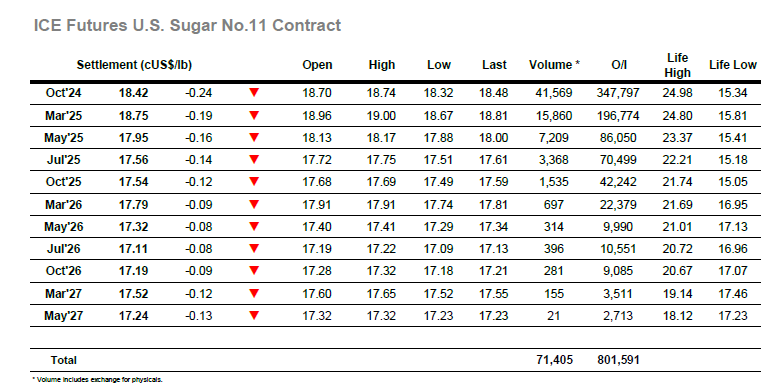

The Oct’24 started the day marginally higher however the gains quickly eroded, and the market fell back away into the 18.50’s. The buying which had supported things so well yesterday afternoon was absent, and the price continued to drift through the morning before finding a degree of support in the 18.30’s. This really left the market in no mans land and while the start of the US day drew some fresh buying to bring the price back up to 18.50 there was no indication that the recovery could extend back to the morning highs as the buying remained so light. Eventually the price faded back to 18.35 and matched the earlier low, but boredom had by now set in for most and the volume reflected that many had ceased activities early ahead of the weekend. A little more movement arrived during the final half hour as Oct’24 was first sold down to 18.32 before some late short covering arrived to bid prices back up and end the week at 18.42.

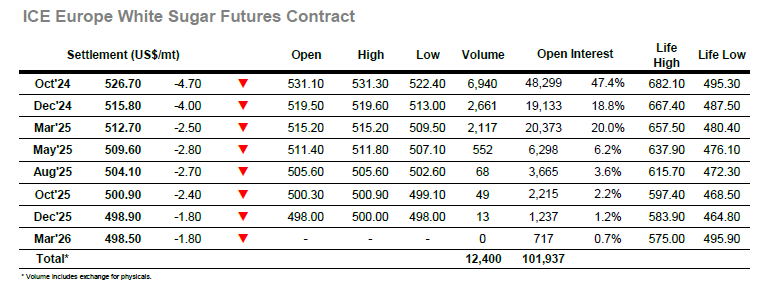

An unchanged opening was not sustained, and the market soon began to slip lower with consumer buyers few and far between having moved away from the midweek lows. It was a steady decline through the morning which extended below $523.00, providing a weaker picture than yesterday’s buyers would have wanted to see and undermining any new confidence. The weakness was leading the spot white premium to lose additional ground with Oct/Oct’24 trading down to $117.50, although this loss started to redress during the early afternoon as the flat price pulled around $3 away from the lows. Trading remained slow as the market then developed into a sideways pattern, leading to a lot of clock watching among the brokers as they urged the close to come around. Whether through short covering or just defensive action the market did pick up during the last couple of hours with Oct’24 returning to $528.00 on the close though settling beneath this mark at $526.70. This left the Oct/Oct’24 in small credit at $120.60 to end the week and leave the market heading into the weekend in less bad shape than had seemed likely earlier on.