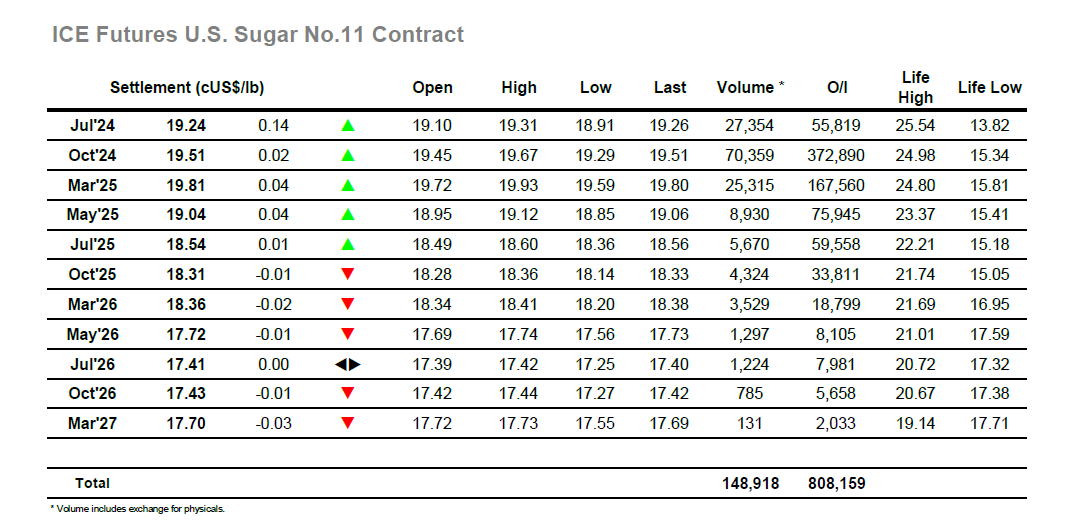

It was a far calmer start to today’s session with the dust having settled upon the shenanigans of the previous two days, and Oct’24 settled into a sideways pattern which saw it holding a 12-point band for most of the morning. A nudge back to 19.46 around noon widened this band slightly while the arrival of the US specs then drew some buying which sparked a move to new daily highs at 19.67. These highs were short-lived, and liquidation then sent the price falling to new session lows, though in reality these movements were based on low volumes and day trader/algo activity so meant little in terms of the bigger picture. Alongside this malaise there was more significant movement being seen at the top of the board where Jul’24 spreads were starting to make a recovery and reverse some of the recent losses, with Jul/Oct’24 moving from a low at -0.42 points to reach -0.24 points during the afternoon. The flat price meanwhile worked down to new lows at 19.29 before moving back up to mid-range on short covering, though few people appeared to be showing much interest. The rest of the session largely petered out, with only some late buying which pushed prices higher on the call / post close to enliven proceedings and leading to a close at 19.51 which leaves parameters unchanged.

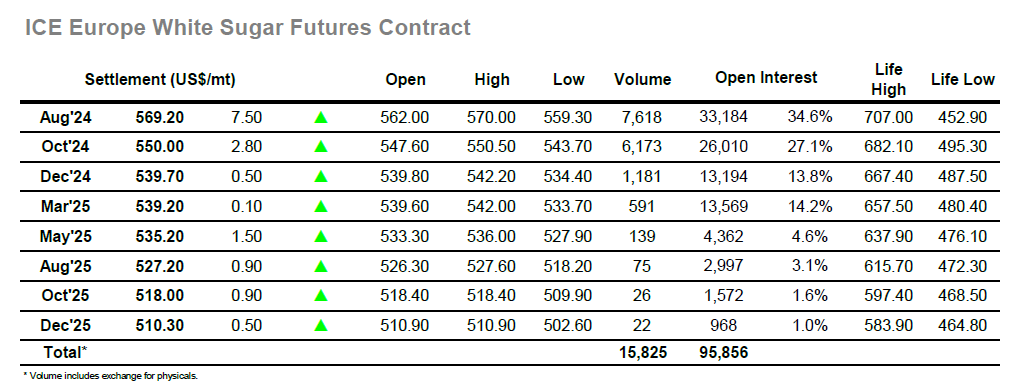

There was little change to nearby white’s values during early trading and the sideways pattern endured through the morning as Aug’24 generally consolidated minor losses on low volume. The picture only enlivened during early afternoon when the market reacted to some light buying with a move through to $566.50, though this soon faded, and the price pulled back to where it had come from. Still, it served as some small motivation for buyers and set in motion a more positive trend for the next few hours. This was aided by steady buying for the Aug’24 spreads which widened out by several dollars across the afternoon, Aug/Oct’24 reaching a high at $19.70, a gain of $5.20. The strength was also shown for the Aug/Jul’24 arbitrage which moved beyond $146.00, though with Jul’24 expiring this Friday the volumes here are paltry and it has become somewhat unrepresentative, instead the Oct/Oct’24 which widened by a couple of dollars towards $120.00 provided a better representation of movements. The upward trajectory for Aug’24 was maintained right the way through into the close where session highs were recorded at $570.00, narrowly avoiding a second consecutive inside chart day as settlement was recorded at $569.20.