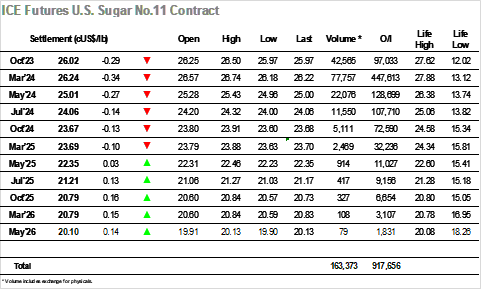

There was a lack of confidence about the market following yesterday’s correction, and the day began inauspiciously with unchanged opening prints soon giving way to further losses. These losses extended to 26.40 for March’24 before some buying was uncovered, in turn enabling the market to try and stabilise with consumers leading the way to sit values near to unchanged through the later morning. The catalyst for the correction was liquidation from the shorter-term specs and they were again absent from the long side today which enabled values to slide once again, with the early afternoon seeing a move beneath the morning lows and extending the decline to 26.32. Buying then reappeared ahead of the publication of UNICA data for the first half of September, which showed production for the period at 41.764mmt cane / 3.116mmt sugar / 51.10% mix / 153.27 kg/t ATR. This news sparked some fresh buying enthusiasm with the numbers coming in marginally lower than expectations despite still being sizable, leading March’24 to spike up to 26.74. There remained no continuation interest from the specs however and so the rally was soon retraced to leave the price holding back around the lower end of the range. There was to be a final twist as the closing stages drew some further aggressive spec selling, sending March’24 down to 26.18 and establishing a negative settlement value at 26.24. Oct’23 open interest continues to be large with the expiry fast approaching and stands at 97,033 lots. Either there are a lot of AA’s to follow this week or we may be looking at a record delivery, either way it certainly has the specs spooked for the moment and is contributing to their current reluctance to pursue the long side with any aggression.

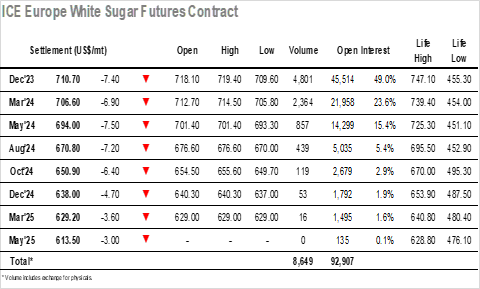

Opening at unchanged there was a glut of selling quickly pouring into the market which sent the price tumbling to $711.60. For a while the market struggled to find any coherent direction though gradually some underlying consumer interest did provide a degree of support and took prices back up to sit either side of unchanged. Consolidating for a while provided the potential to stem this week’s losses, though by early afternoon such thoughts were forgotten as pressure was against starting to be applied at the top of the board. A steady decline ensued which took us to a new daily low at $711.00, before finding support on the coattails of the No.11 market when buying emerged in reaction to the latest UNICA data. With the technical picture appearing exposed for the moment this rally failed to sustain however and by late afternoon the market was once again looking to the lows and searching for support. This weakness was impacting upon the white premium values with March/March’24 slipping back to the $125 area, though in reality the premiums were seeing very little volume change hands. To the downside there remains a gap between $697.60/$701.70 dating back to last month and this may give the short-term traders a target should the current vulnerability continue, it was certainly moving into closer focus during late afternoon as another set of daily lows was registered at $709.60 on closing selling with settlement made just above at $710.70.