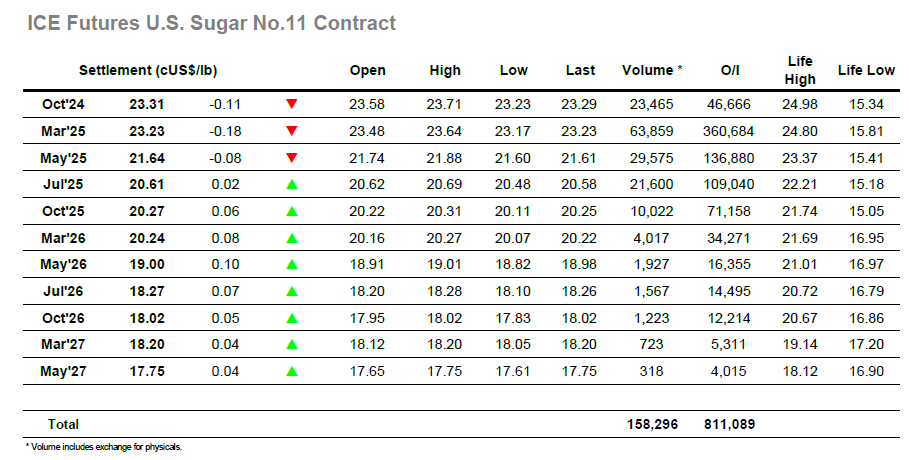

There was a predictable push higher as we opened with March’25 extending the rally to 23.63 before pulling back to the 23.30’s on low volume as the initial buying dried up. The mood remains positive though and by the middle of the morning things had levelled out around 23.50 to leave prices treading water for the rest of the morning but positioned to try and continue building. A small push developed just after noon which brought a marginal new high at 23.64, however there was no continuation interest from US specs and so prices soon retreated to the range for another period of consolidation in the 23.40’s. With the specs (and by default the algo’s) showing limited participation the volumes we markedly down on many recent sessions, and the same could be said of Oct’24 as it edges nearer to expiry. Here the Oct’24/March’25 spread was maintaining a small premium, and with a sizable drop in the open interest yesterday to now stand at 46,666 lots the expiry process is continuing in a very orderly style. There was a wobble later in the afternoon as March’25 pushed down to 23.17 before some defensive buying emerged to bid the market away from this mark heading into the close. Their efforts yielded only limited success with March’24 stumbling to a settlement price at 23.23, while Oct’24/March’25 maintained its modest premium and closed at 0.08 points.

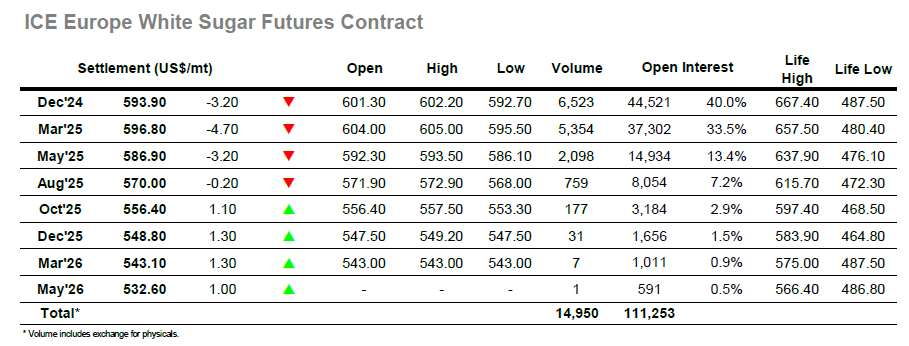

Dec’24 opened above $600 but quickly slipped back down by several dollars, though on thin volume such movements were not being regarded with any significance. By the middle of the morning the picture was turning positive again and having broken back above $600 the price began to grind towards the recent $602.40 mark. For the third consecutive session this level proved to be insurmountable as the market stalled just 0.20c shy, a source of frustration to the longs who reacted with a round of long liquidation that sent the price tumbling back to unchanged. A slow period of sideways trading ensued through much of the afternoon as the specs retreated to the sidelines, though the spot was performing better than the past couple of days with the Dec’24/March’25 spread regaining some lost ground and reaching an intra-day high at -$1.60. Any optimism that this may lead the market to look higher one more time was extinguished during the final two hours as prices instead took a downturn, the lack of progress encouraging some light liquidation which eventually set the price back to $592.70 at the death. Dec’24 settlement was only just above this level at $593.90, by no means a disastrous close despite being lower but suggesting that the continuing failure above $600 is bringing some uncertainty.