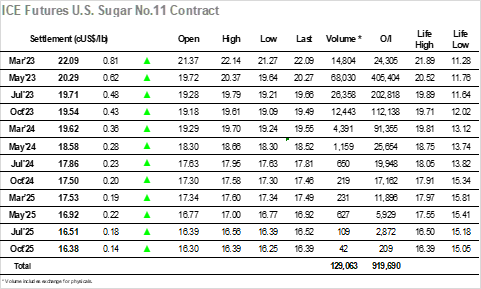

It was a slow start to the week as May’23 clawed some early gains before holding onto moderate gains either side of 19.80. Friday had seen the long overdue publication of the COT data for cob 31st January, the number coming out in the anticipated area of the time at 216,746 lots long to reflect the higher market movement. Hopefully, the data for the subsequent three weeks will follow soon to allow traders to have a full picture available once more, though the broad sideways movement and volume traded through February suggests that the live position will not be a long way from this number. It was not until the afternoon that we started to see some movement, with the arrival of some fresh buying helping May’23 to work back upward toward 20c and reverses some of Friday’s losses. A succession of waves saw the price extend to 20.10 with around an hour of the day remaining, at which stage the specs upped the ante with a far more aggressive period of buying which took May’23 to 20.37 ahead of the call, while May/Jul’23 returned to 0.60 points. The call saw a wave of profit taking to leave May’23 settling at 20.29, still a strong ending to an “Inside day”, with the movement having almost recovered the ground lost on Friday. With many traders in Dubai this week for the conference there will be plenty of discussion taking place, and after todays recovery could this present the opportunity that longs have been looking for to extend the contract highs. March/May’23 continues its journey north as the pre-expiry squeeze gathers pace, today reaching 1.80 points. Open interest dropped again to 24.205 lots with further reduction anticipated following today’s activities.

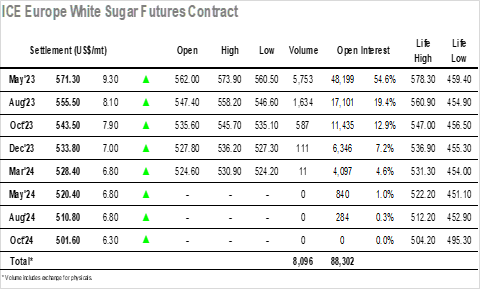

The usual opening volatility against hedge lifting saw May’23 trade either side of $562.00 before things settled down and allowed a boring morning of consolidation to take place a small distance above unchanged. There was no spark being found ahead of the US day, though the fact that prices had not collapsed on the back of Fridays sharp correction seemed to provide some encouragement to day traders/specs as they brought in some additional buying to drag prices into further credit early in the afternoon. A couple more waves of buying then followed as the afternoon progressed, though the more concerted efforts were reserved for the final couple of hours when progress became more gradual as some scale selling started to be encountered. Still May’23 drove all the way to $573.90, placing it near to last week’s contract highs once more, but while the spreads were also rallying on the buying they were not as firm as may ordinarily be expected as May/Aug’23 extended only to $16.10. The close saw some profit taking which dropped values back a touch to leave May’23 settling at $571.30, and while the close was positive with Fridays plunge having been reversed the hard work will begin now if the specs are to force a sustainable move outside of the broad February range.