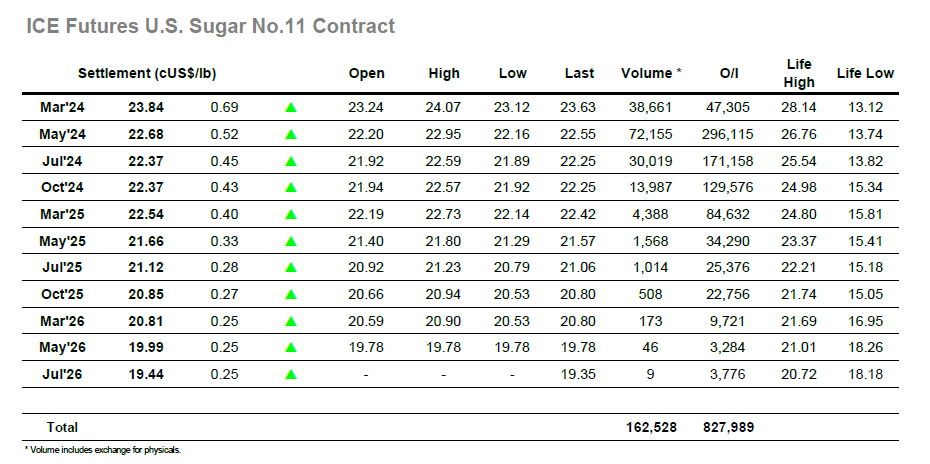

The market began the day a little firmer and though the May’24 contract initially failed to pull away as the price returned to unchanged the support was obvious in response to yesterday’s firmer showing. Soon this had an impact with the price pushing upward to a mid-morning high at 22.37, though such is the nature of the specs that there was another return to 22.16 before the morning was through. Sentiment from yesterday’s bounce remained the main driver though and as the afternoon began so another push higher was mounted which led prices back within proximity of the morning highs. The March’24 contract was also performing well with the recent resurgence of the spreads continuing as the March/May’24 value moved up to 1.04 points. New highs were recorded for May’24 at 22.49, and while the specs seemed unwilling to through excessive volume at the market, they remained involved in holding prices steady through the afternoon within a band centred upon 22.40. This left things well poised to finish firmly for a second successive day, and the specs did not disappoint in looking to achieve this with a late burst of buying that saw the price spike to 22.95 on around 14,000 lots. No sooner had the buying concluded than we saw a similarly speedy drop back to 22.48 on liquidation with the close taking place in amongst this seeing May’24 end at 22.68. The March/May’24 spread meanwhile saw a new high at 1.17 points late on, and with March’24 open interest reported at just 47,305 lots as at yesterdays close we may see more front month volatility across the remaining two sessions.

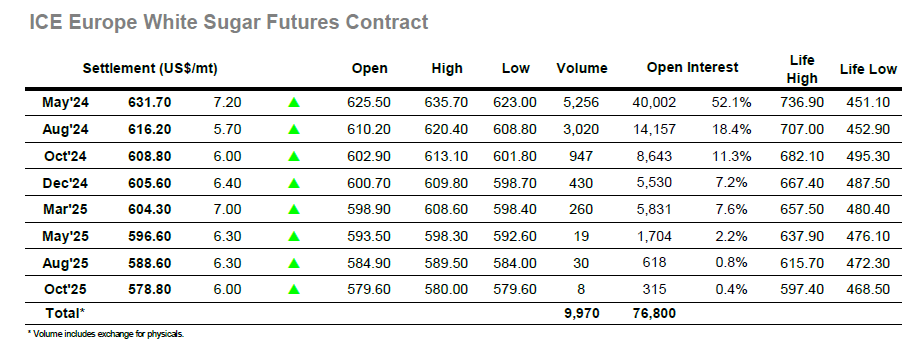

Opening activity either side of unchanged set the tone for an inconclusive morning performance which saw May’24 range between $623.00 / $627.80 without showing any intent to break out to either side. This pattern continued through the early afternoon with low volume still being seen for outright positions and only moderately more activity found within the spreads where May/Aug’24 was again nudging around the $15 area. With a little more spec buying appearing to the No.11 market the price did move up from the range and extend parameters to $629.10, however there was a reluctance to follow and so the white premium values started to feel some impact and May/May’24 slipped back to the lower $130’s. on still low volume this pattern seemed set to endure for the rest of the session but the US specs had other ideas and as the No.11 spiked during the final 30 minutes so the whites were compelled to follow. May’24 spiked to $635.70 in response though it was an unconvincing reaction with volumes traded being in the hundreds, while despite the rally there was a further dip in the white premium to $129.00. The gains were not sustained, and end of day position reduction meant a settlement at $631.70, while the May/May’24 bounced back to close at $131.70. This still represented a steady close for the charts as traders look to reverse the recent trend though there remains a distance to go before we can consider any possible break from the broad prevailing range.