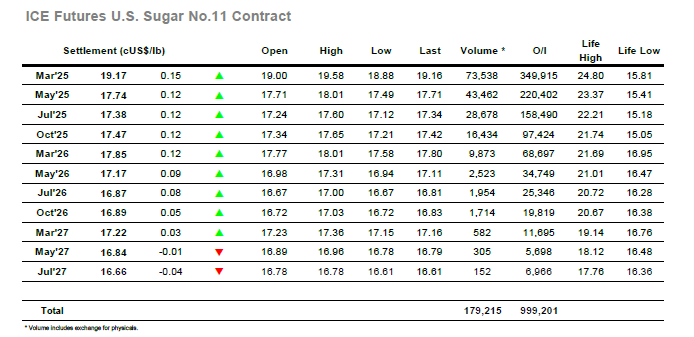

There were wild opening swings as March’25 started between 18.88 and 19.13 and having settled down for a brief period the upward movement resumed in a continuation of recent action. There was little resistance to be found as the price accelerated ahead into the 19.30’s, and in the process widened March/May’25 out towards Fridays widest levels as it returned to 1.50 points. The COT report showed an expected growth in the net short holding as of 21st January to stand at -139,873 lots short, and while some of this position has undoubtedly reversed across subsequent sessions there are clearly concerns as to the downside sustainability in some sectors which is continuing to fuel the recovery as the cover positions. With the trade also continuing to show as buyers the market forged further ahead through the middle of the day to reach highs at 19.58 for March’25 and 1.58 points for March/May’25, placing the flat price a mighty 2.01 points above last Tuesdays lows. These higher levels could not be maintained with the market pulling back to the 19.30 area against profit taking by longs, and from here a degree of fatigue set in with some further erosion of the morning gains seen to lead March’25 back into the teens. Still, this represented another moderate gain and while the March’25 close at 19.17 was not as impressive as some would have been anticipating this morning the trend reversal remains in place with the picture still looking constructive for the near term.

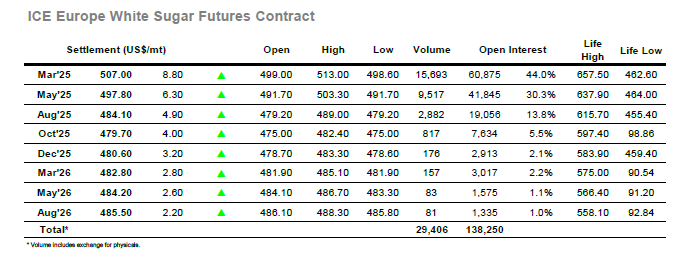

Another solid start to the day saw March’25 quickly continuing upward through $500.00 with the price movement only levelling out having reached the $506.00 area within the first hour. Last weeks resurgence has clearly shifted sentiment in a significant way and while the rest of the morning proved to be relatively calm the general upward bias maintained with the March’25 price edging up to $509.20. There was another jump higher as those in the Americas got their week underway with the fresh buying rallying the market to $513.00, and only at this stage did the market cool with some small trader selling / profit taking emerging. As with last weeks movements the flat price rally was building in conjunction with spread buying, and as the March/May’25 roll gathers pace there was some concerned rolling by shorts which helped to widen the differential to $10.80. These values cooled a little during the afternoon as the flat price set back into the range, though a solid proportion of the gains was being maintained with the whites showing more solidly than No.11 and illustrating the level of trade support also present on the rally. This aided the white premiums with another strong showing at the top of the board valuing March/March’25 at $84 as the afternoon moved forward, its highest level in almost four weeks. Moving towards the close we saw prices remain resolutely to the centre of the range, ensuring another solid close as March’25 settled at $507.00.