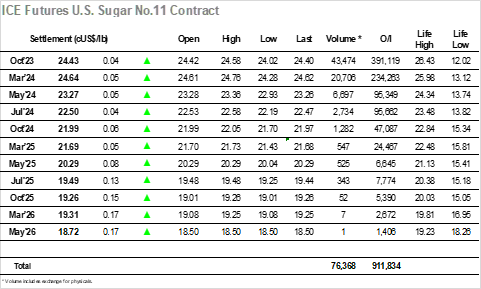

There was some early buying around with the fall over the past couple of days drawing out some light physical pricing, however once that was concluded the market proceeded to make an about turn to work lower once again. There was very little support in place until Oct’23 reached the teens, but while it reduced downside movement there was no reaction and the market proceeded to to work sideways for the next few hours. The afternoon brought another push lower which extended the range to 24.02, though having held 24c there was the first signs of some short covering from day traders that sent Oct’23 back up to the relative comfort of the 24.20’s. Throughout these movements there continued to be focus upon the Oct’23/March’24 spread, and to its credit the differential itself to recent parameters, trading no lower than -0.26 points. The later afternoon saw spec/trade buyers buoyed by the way prices had held and looking to push higher once again, sending Oct’23 back into credit with the price holding in the 24.40’s ahead of the close. The call was subdued to leave Oct’23 settling a mere 4 points higher at 24.43, a decent performance in the context of the day’s movements with a continuation of the current range remaining the likely way ahead.

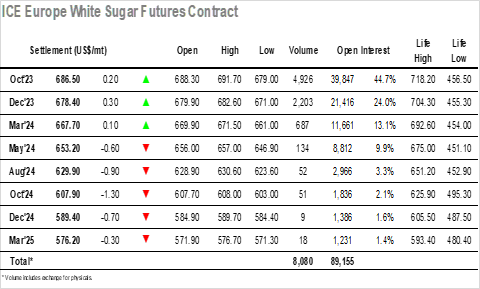

Initial buying saw Oct’23 trading back up to $691.70, however once it was concluded the price soon fell back to fill the small gap on the intra-day chart and ease beneath overnight levels. As with the last couple of days the market was finding it tough to uncover any significant support as consumer buyers are continuing to stand away, and so it was that the price eroded further through the next few hours with Oct’23 recording a low at $679.00 during the early afternoon. Activity remained modest throughout, and while there were hints of some day trader buying / profit taking to stabilise the price back above $680 it felt as though the day was done. That proved to not be the case as buying stepped up during the final two hours to bring values back into credit for the day, slowing down when still shy of the morning highs though maintaining the recovery heading towards the close. The recovery helped with white premium values, bringing them away from their lows to leave Oct/Oct’23 closing around $148.00. Oct’23 settlement at $686.50 will have pleased longs as it halted the decline, though overall it simply maintains the market prognosis of range bound trading.