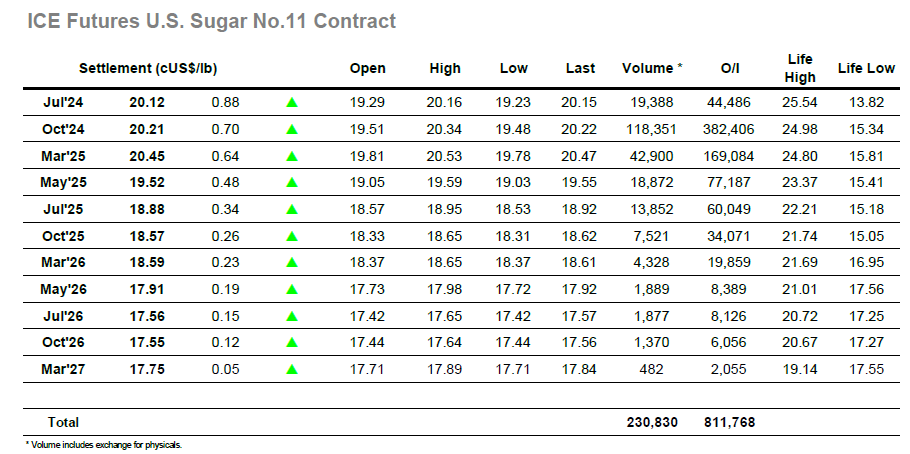

Though yesterday saw an inside session on the chart there was a fresh enthusiasm about the fact that Tuesdays gains had not been fully rejected and so we began with supportive buying seen down the board which set the market higher. Though initial progress proved tricky the consolidation pattern combined with stronger London whites provided the basis to start working through the grower scales, and by early afternoon Oct’24 was able to challenge the early May highs. This it did rather comfortably and having secured the 20c area a second push upward followed, extending the gains to 20.34 as short covering poured in. Spreads were also firm with Oct’24/March’25 reaching a high at -0.19 points, though of greater interest was the Jul/Oct’24 ahead of tomorrows Jul’24 expiry. Here the market firmed right the way into the close on limited liquidity, wiping out much of the discount in reaching -0.07 points. A dip back ahead of the final hour was gathered up and the closing stages saw quiet support ensure a positive conclusion, settling Oct’24 at 20.21 to confirm the break to new ground a present a positive chart picture.

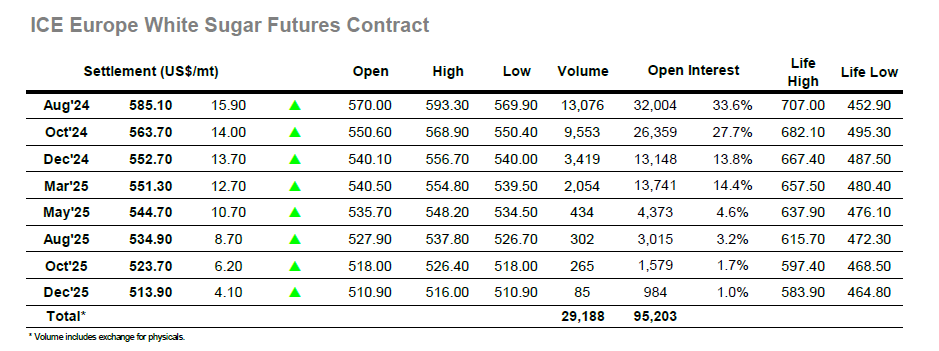

Having worked back up through the range yesterday the market resumed in a more positive situation and opening buying looked to build on this by immediately printing Aug’24 up to the mid $570’s and fresh recent highs. The attitude seemed very different from recent sessions with a resolute determination to maintain the push, and across the morning this persistence saw Aug’24 edge through scale selling to reach $580.00 and bring the early May highs into focus. For the next few hours, the trend maintained in much the same way, grinding up through the scale sell orders in a systematically positive style and providing the groundwork for a move to 2-month highs. This duly occurred with a couple of hours of the session remaining as greater spec interest saw Aug’24 accelerate ahead to a high at $593.30, widening the Aug/Oct’24 spread to $27.00 in the process. Such sweeping gains were tricky to maintain given the level of small trader participation, and despite the best efforts of buyers the final 10 minutes saw a retreat against position squaring which met with little opposition. This sent Aug’24 back down towards $584.00, and though settlement was away from the highs its level at $585.10 still represents a very solid performance.