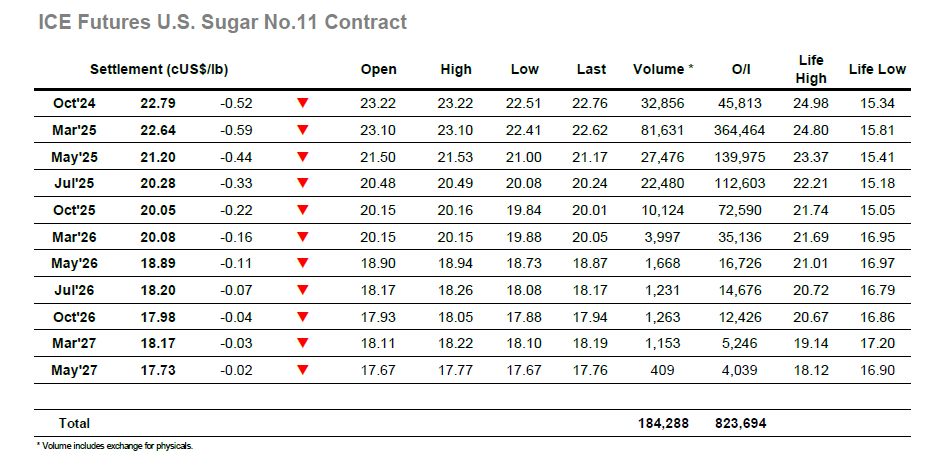

Yesterday’s weaker close had clearly dented confidence in a significant way as the reaction saw March’25 commence trading at 23.10 and then accelerate down to 22.45 (-0.78) across the next 30 minutes. Once the selling eased up there was a small recovery to sit in the 22.70 area, though it was clear that the mood had changed significantly from that of the past couple of weeks with the specs now having to reassess their next move. This led prices to hold a sideways pattern for several hours with no hint of a move in either direction, though the closer we drew to the publication of the latest UNICA data so traders became prepared for a reaction. The data revealed production of cane at 42.933 mmt / Sugar 3.124 mmt / Mix 47.86% / ATR 159.52 kg/t / Ethanol 2.435 mlt, and the initial reaction was to push the market back up to 22.96 though this proved incredibly short-lived. The sharp retreat which followed ended with a new session low at 22.41, just a few points above Monday’s low to virtually eradicate all this week’s progress. It was not all doom and gloom as the market did manage to pull itself away from the lows during the final two hours, though a close at 22.64 was not particularly impressive and raises questions as to whether there will be additional corrective movement. Tonight’s COT report is sure to show a sizable rise in the spec long as it will represent activity during a 5-day period of immense strength, though a portion of the reported number will likely have liquidated over the last day or so.

Oct’24 moves into its final day still maintaining a premium to March’25, ending the day at 0.15 points. Open interest was reported at 45,813 lots as positions are increasingly aligned ahead of the tender.

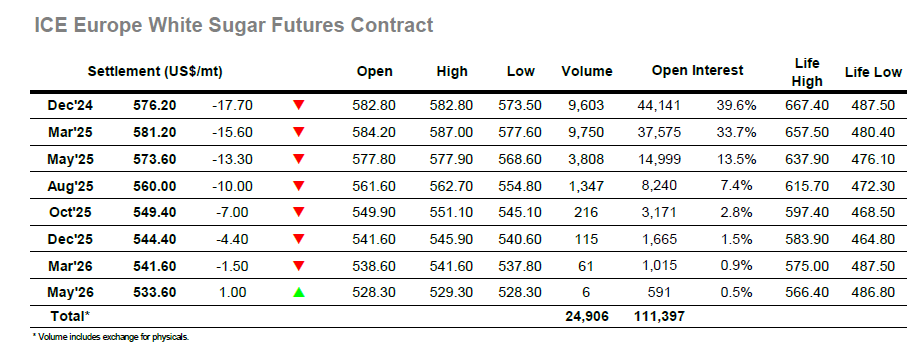

Reacting to lower No.11 values there was a large gap downward on today’s opening with Dec’24 initially printing $11 lower and continuing to fall to $576.40 despite volume not having reached 1,000 lots. This underlined the lack of buying at the elevated levels once the speculative sector step away, and though prices then looked to level out there was no sign of recovery. The morning continued sideways on low volumes as traders took stock of the situation, with the arrival of the US day also failing to make any impact as the narrow trading band maintained. There was some movement midway through the afternoon as a little long liquidation appeared to extend the low to $573.50, however it did not generate any significant selling, and the price managed to return to the $580 area. Nearby spreads were under some pressure, understandable given that most liquidation was taking place in the spot, with Dec’24/March’25 dropping back to -$5.60 discount. In keeping with the mood of the day there was limited movement on the close, leading Dec’24 to enter the weekend at $576.20, and with the former gap to $572.00 not yet fully filled some interesting technical possibilities remain heading into next week.