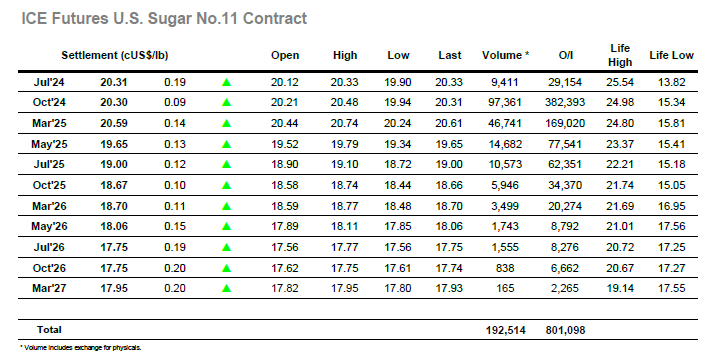

The day began slowly with the market tracking sideways through the first couple of hours, though some enthusiasm then returned from buyers mid-morning to bring Oct’24 back up into the 20.30’s. There was no concerted movement however and long liquidation was seen prior to another spec led push early in the afternoon, this move bringing a spike to new two and a half month highs as Oct’24 reached 20.48 before topping out. News has been thin, however today brought the latest UNICA data and so the market set back into the range ahead of its 3pm release. When published the data showed Cane 48.998 mmt / Sugar 3.12 mmt / Mix 49.70% / ATR 134.47 kg/t / Ethanol 2.248 mlt, a little above expectation and triggering a quick price decline back to 20c. It took a while for the market to re-gather down around the lows and it was only during the final hour that the price worked back up into positive ground with some supportive pre-weekend interest taking Oct’24 up to settle at 20.30 and leave it well positioned for Monday when it commences its tenure at the top of the board. The Jul’24 expiry is expected to see 21,277 lots (1,080,925t) tendered. Details are still emerging, and full information will be published by the exchange on Monday.

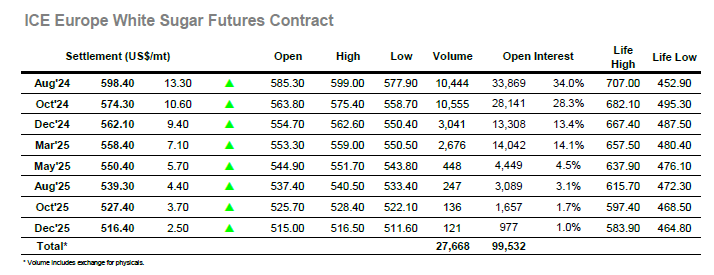

Initially the market struggled to build upon yesterday’s strong showing with Aug’24 dropping back by around $7, though this contrasted with the wider picture (No.11 was showing little change) and over the course of the morning the value steadily recovered towards unchanged. Volumes were starting to pick up, in no small part due to the increasing Aug/Oct’24 volumes ahead of next months expiry, but that had no discernible impact upon the flat price which continued to weave its way through the lower/mid $580’s well into the afternoon. The final third of the session proved by far the most interesting as the whites broke away from No.11 and began to break fresh upside ground once more. This had significant implications for the white premiums and spreads with Oct/Oct’24 working rapidly through the $120’s to trade beyond $127.00, while Aug/Oct’24 moved from a low at $18.00 to reach $25.90. Highs were recorded at $599.00 late in the session, the highest Aug’24 price since 12th April, with settlement made just shy at $598.40 prior to some post close position squaring to leave the market looking strong into the weekend.