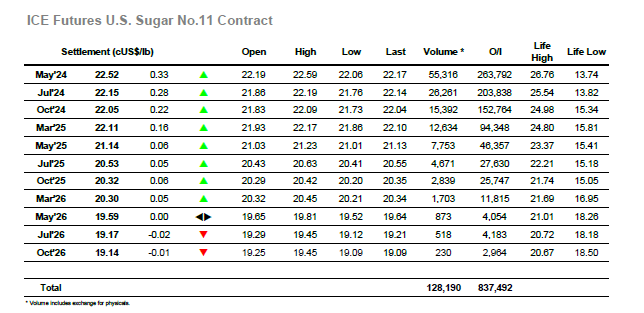

Early gains were soon erased with a sharp push back to 22.06, however the market soon gathered itself to return to credit and consolidate the 22.30 area. This provided a solid base from which to loom to build once again ahead of the extended Easter holiday weekend and as the US specs came online so the market found the necessary impetus to work upwards once more with May’24 moving to the upper 22.40’s. The positive movement also drew renewed buying to the front month spreads and as the flat price pushed ahead to 22.59 during the early afternoon so the May/Aug’24 spread widened back out to 0.40 points. This represented the highest levels seen for May’24 since 29th February though as seen regularly with the hedge funds mostly inactive there was no continuation interest for the move and so spec/day trader liquidation sent the price back down into the range. Recent movements have incentivised the longs to try and ensure a strong conclusion to Q1 and so the push back up through the range during the final couple of hours was well anticipated though scale resistance saw the move fall just shy of earlier highs. A mixed close saw both some position squaring and defensive buying, all of which left May’24 settling at 22.52, ending the quarter on a positive note.

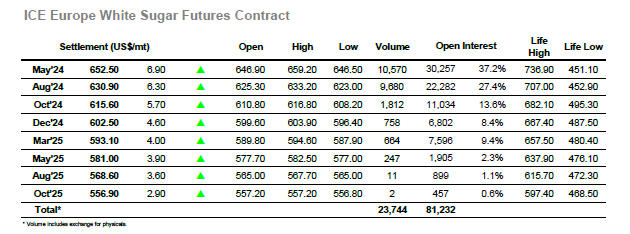

May’24 started the final day of the quarter positively with a push up to $649.90, and while the initial momentum waned there was sufficient buying interest around to bring prices up through $650 soon afterwards. The whites have proved strong recently and so following a period of consolidation the appearance of fresh buying surprised few and an early afternoon surge followed, against widening both spread and white premium values in the process. May/Aug’24 traded to a widest $26.70, aided by the flat price, though with just a couple of weeks to the May’24 contract expires the rally attracted the interest of sellers keen to roll positions down the board. Having traded up to another monthly high of $659.20 the market encountered some liquidation which sent the price quickly back by $10 and take the shine off the performance and leave prices back firmly to the range. Longs were determined to maximise the valuation of positions ahead of month/quarter end and so buying reappeared during the final couple of hours to bring values up the range once more, leaving May’24 showing solid $10 gains for the day as we moved through the final hour. All was calm until the final 15 minutes when some end of month/quarter position squaring sent May’24 back by a few dollars with settlement established at $652.50. May/Aug’24 finished near to its lows at $21.60 while arb values were off the highs at $156.00 for May/May’24 and $142.50 for Aug/Jul’24.