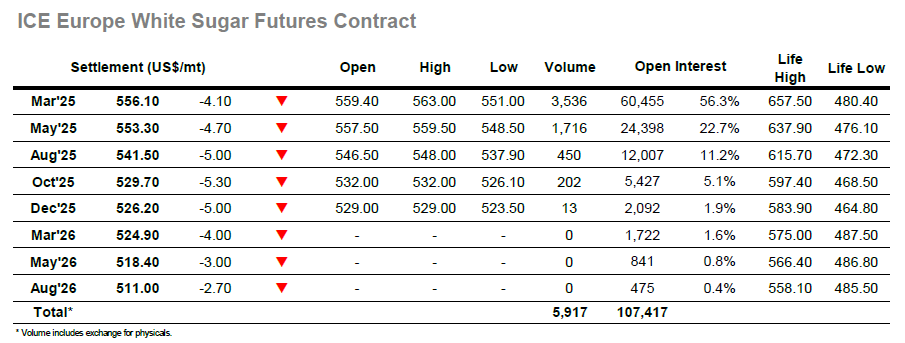

There was significant movement through the early part of the session as March’25 fell back from an early $563.00 high to be trading at $555.30 barely 20 minutes later. Trading then calmed for a period however the market remained open to movement with few resting orders to be found as many traders stayed away due to the Thanksgiving holiday in the US and closure of No.11. Another round of light selling later in the morning extended the losses to $551.00, but with this placing the market more than $9 beneath settlement buyers started to appear, likely in the expectation that such losses would not be matched by a similarly sized opening call when No.11 resumes tomorrow. Having pushed March’25 back over $555.00 the buying eased off and a prolonged consolidation/drift ensued with prices holding to the bottom end of the range without ever threatening to test the lows again. The losses reduced during the final hour with March’25 pulling up to settle at $556.10, indicating a potential lower start for No.11 tomorrow with further rangebound trading anticipated.

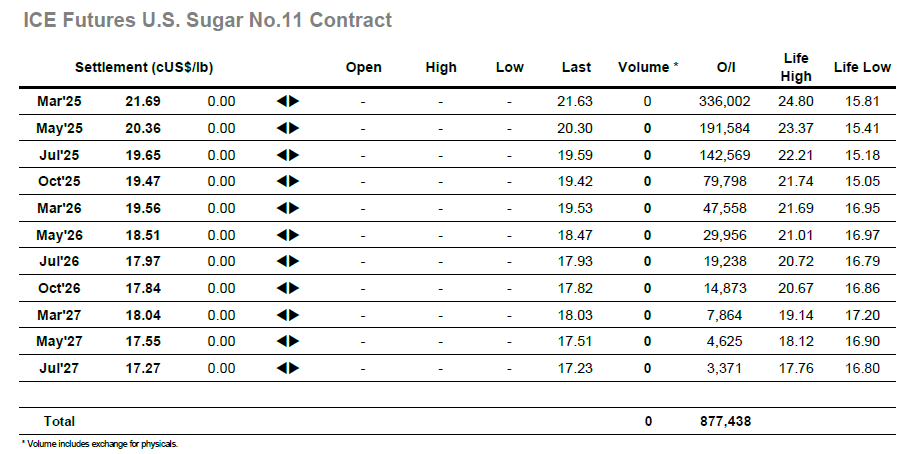

No.11 Market closed today in observance of Thanksgiving holiday.