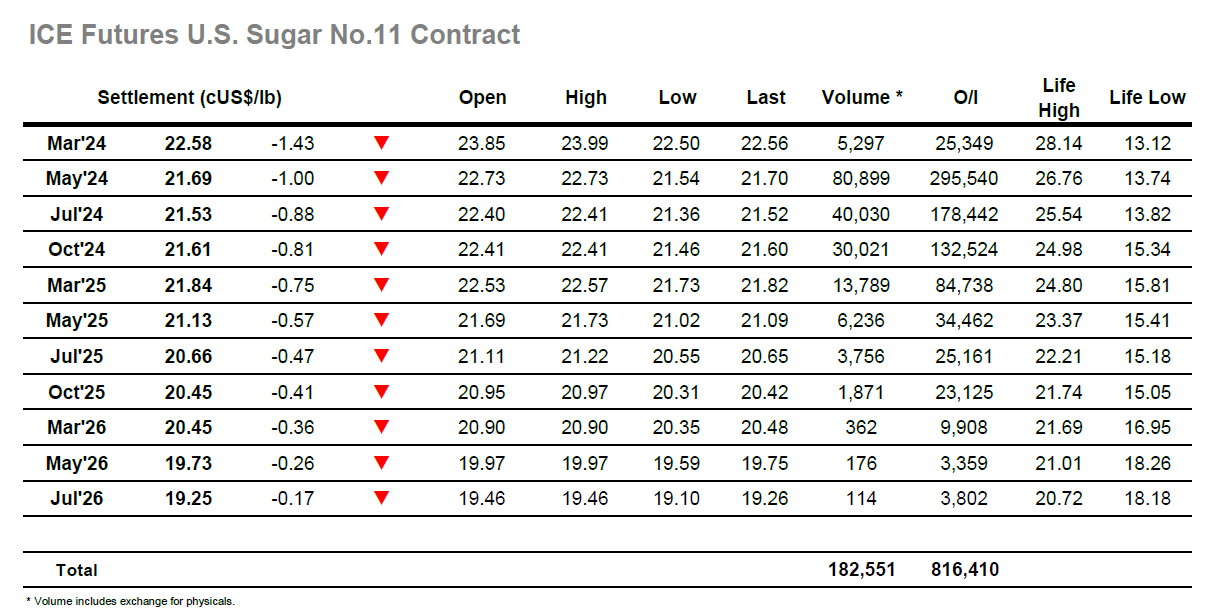

Higher opening prints were short-lived with May’24 immediately plunging down to 22.50 despite only seeing light volumes, though things soon settled down to consolidate quietly in the 22.60 area. The quiet nature of yesterdays inside day may have caused some concern amongst specs as to the level of buying interest needed to maintain this week’s recovery, and with the market stalling this morning some liquidation started to emerge and send prices down to new lows. This weakness set the market into something of a spiral with the early afternoon seeing the decline extend quickly towards 22.00, and then on to a low at 21.77 before finally discovering an element of support from consumer interest. It was not just the May’24 contract under pressure with the whole board following lower, and this meant that while the spreads were giving some ground back the losses were not catastrophic with May/Jul’24 seeing a daily low at 0.20 points (-0.08). At the top of the board the March’24 contract was also significantly weaker with the spread buying seemingly complete, and this meant that the flat price saw losses of more than 1.00 points while March/May’24 contracted from an early high at 1.37 points to be trading at 0.95 points midway through the afternoon. This was not to be the end of the pain as remaining longs eventually threw in the towel while new short positions were established by the faster moving specs, and with buying limited to scales we popped beneath the recent lows to a new mark at 21.54. There was some end of day short covering which meant a settlement at 21.69 however it did not disguise a weak performance which completely wiped out the progress made over the past week. The March’24 expiry saw March/May’24 expire at 0.89 points premium. Early news is that we will see 25,751 lots (1,308,215t) tendered.

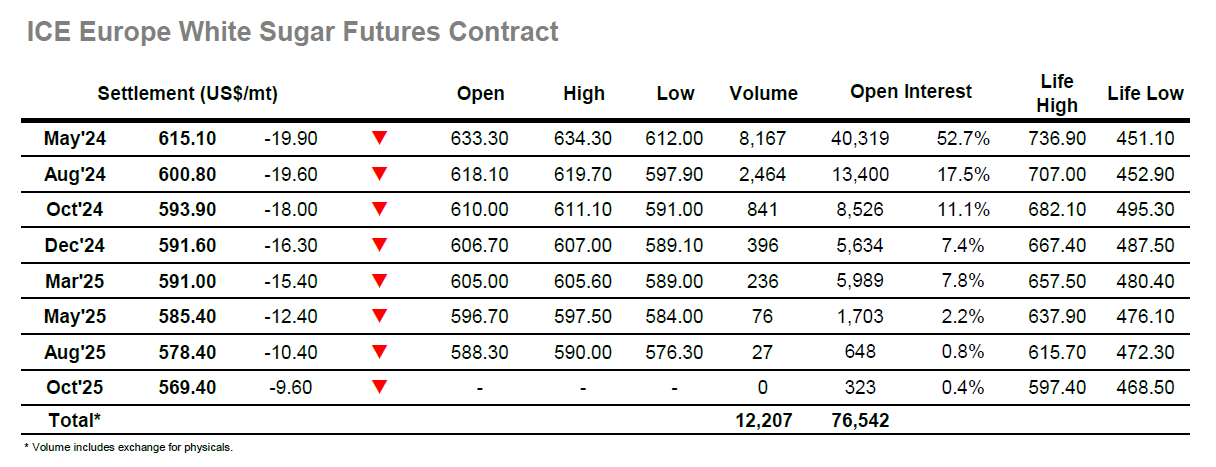

There was a marginally lower start for the market today and though May’24 attempted to hold the low $630’s by mid-morning the support had dried up and instead some spec selling / long liquidation began to take place and sent the price down to $625.30. In recent days there has been some white premium contraction as the whites have proven somewhat a reluctant passenger to the spec driven No.11 movement, and so an easy softening was not wholly unexpected when the opportunity arose as consumer buying remains focussed closer to the recent lows. Additional reversal of this week’s rally took place during the early afternoon with the price falling back to $616.20, and it was only having reached the teens that a little more buying did emerge, and the situation calmed to a range. The movement was allowing for the white premiums to recover some lost ground as the greater spec volumes for No.11 generated wide moves, and during the afternoon we saw May/May’24 touching back to $127 and Aug/Jul’24 to $127. Following a period of attempted consolidation there were more losses to come, with May’24 reaching a low at $612.00 heading into the close to be just a couple of dollars above the recent lows. There was some MOC buying / position squaring which meant a settlement at $615.10 however overall, it was a sloppy performance which suggests we may see additional support testing ahead of the weekend.