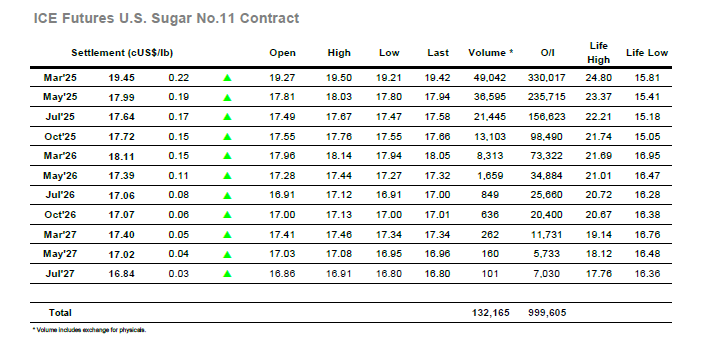

The market was back in to attack mode as we opened with the early stages seeing March’25 surge back up to 19.50. This failed to generate any additional buying however and with the smaller traders soon looking to close back out the initial longs the market retreated to overnight levels by the middle of the morning. The rest of the morning saw prices edge back into positive ground but on little volume, with things only picking up when the Americas based interest emerged during the afternoon. With the newswires reporting reduced estimates for both the Thai and Indian crops the market received a shot in the arm and returned to challenge the morning highs, but despite various efforts it fell just short on each occasion leaving prices to hold the range. Spreads were seeing tighter ranges than yesterday with values never erring very far from last night closing levels, and here too the volume was moderate at best as interest waned. There was an uptick in interest for March/May’25 as the market headed into the close and this sent the price to a daily high mark at 1.49 points, though outright values of contracts continued to sit just shy of the earlier highs. Settlement was made at 19.45 to represent a sixth successive daily gains, though having spent the last two sessions within Mondays range the market will need to break above 19.58 soon if it is not to begin looking a little fatigued.

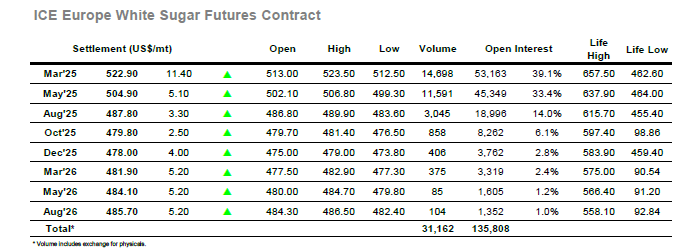

March’25 whites straight-lined higher on today’s opening and reached $520.00 before cooling as some selling crept into the thin environment. The rest of the morning proved to be generally calm from a flat price perspective, however the same could not be said of the March’25 spreads which were already on the move again and making additional gains. Outright values joined this pattern early in the afternoon as March’25 surged ahead to $522.70, and while there was a retreat once again against day trader position covering the market remained at the upper end of the daily range to build yet more positive sentiment. By now the March/May’25 spread had widened to $17.50, with the March/March’25 white premium touching around $94, a remarkable turnaround for both in little more than a week as the pre-expiry squeeze builds. Through the later part of the afternoon there was another strong front month push which extended the range up to $523.30, with the close then seeing the gains maintained in the face of position covering as another new high registered at $523.50 with settlement only just below at $522.90. March/May’25 was also making new highs against MOC buying at $18.50 and closed at $18.00 to complete another very strong showing from a March’25 contract which leads the way in sugar currently.