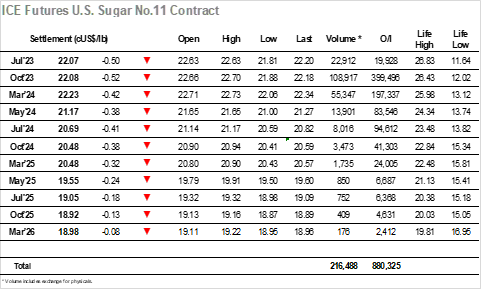

The day started more calmly than recent sessions with another assortment of consumer pricing and hedge lifting providing a degree of support, enabling Oct’23 to shake off some light early losses to sit near to 22.60 through most of the morning. What was notable however was that there remains no desire to push the market back upward at the current time, and so as the clock moved passed noon and the Americas joined the fray the market started to show signs of continued vulnerability. Support was still being felt ahead of yesterday’s 22.40 low mark and so this enabled the market to consolidate this area for a couple of hours, however when the market worked down into the 22.30’s so the pace of selling started to rise once more. Again, there were stops being triggered as both trade and spec sellers showed activity while the nearby spreads took a beating with Oct’23/March’24 working down to -0.18 points. The increased selling (and reduction in buying) combined to see Oct’23 down to 22.00, while at the top of the board Jul’23 was lower still with prints down to 21.94 just 7 sessions since we were seeing a 26c handle for both. There was another push to new lows later in the afternoon which saw Oct’23 extend to 21.88, though short covering kicked in to bring the price back up to be trading above 22c going into the close. Settlement was made at 22.08, away from the lows but still weak after seven successive days of sizable losses. With the market now oversold and with some technical support beginning to arrive from the continuation charts there may be the possibility of some respite in the near term, though the majority will likely want confirmation of a turnaround before buying thus making a sustained bounce tricky for the moment.

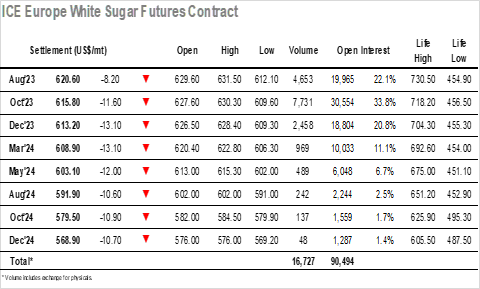

There was a more sedate pace about the market this morning as Oct’23 traded either side of unchanged on moderate volumes, the scale of the recent collapse bringing out more consumer buyers as they look to take advantage of the fall with their pricing. The sideways nature of the morning had some questioning whether the market was at least attempting to build a bottom, however such is the technical weakness presently that as the early afternoon started to see pressure applied there were few willing to stand in the way of the sellers. There was a pause ahead of $620.00 which at least slowed the rate of decline, however when that level cracked so the market entered freefall once again, declining by a further $10 to a low at $609.60. Short covering/profit taking followed which provided some light respite, though prices remained near to session lows moving through the final hour. Through this latest flat price collapse there was some choppiness about the spreads with both Aug/Oct’23 and Oct/Dec’23 trading to a discount intra-day before returning to a premium later in the day. The closing stages saw more concerted short covering to bring the market further up into the range, Oct’23 settling at $615.80 following another day in this series of losses.