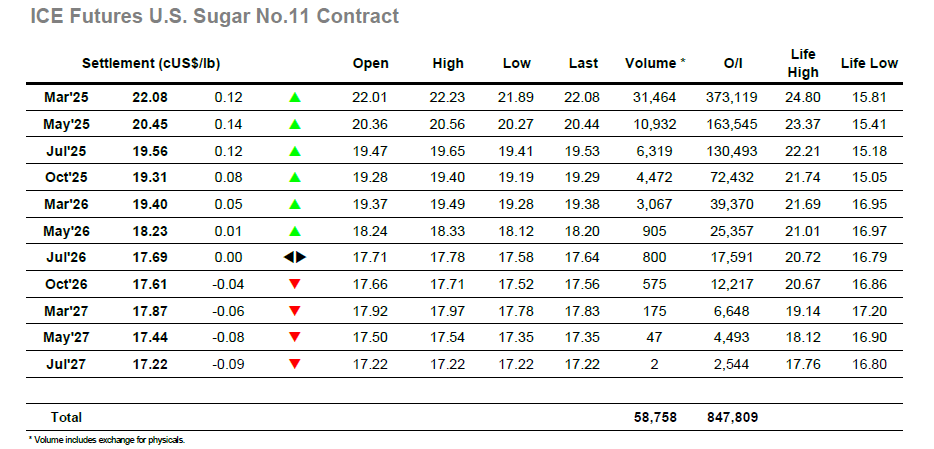

The market opened positively on Tuesday morning, picking up where it left off on the final hour of Monday’s session. Within the first hour buying moved the market up 20 points before reaching resistance at 22.23c/lb, a level that wouldn’t be tested again for the rest of the session. From here the March’25 No.11 gradually ticked back down toward 22c/lb again on very thin volume, giving up most of the initial gains. Into the afternoon and a renewed push higher allowed the market to quickly trade back up over 22.2clb again before running out of steam for a second time. With the US online now, selling, but on better volume saw prices tumble over the next few hours, reaching the day’s low of 21.89c/lb. The last few hours of the session were characterised by a choppy rally into the close, settling at 22.08, up 7 points on the open. Volume on the front month was particularly thin with only 30k lots traded, with the HK spread trading sideways over the day too.

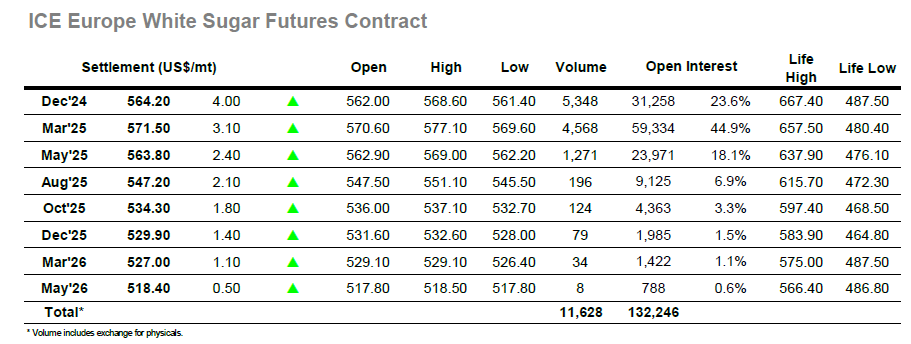

The whites market opened positively too, printing up 4USD/mt immediately on open, and reaching a further 3USD/mt higher within the first 30 minutes. Like over on the raws the Dec’24 No.5 contract proceed to then give up much of these gains over the rest of the morning, trading back through 565USD/mt by lunchtime. The afternoon began with a more aggressive push higher, back up close to the day’s high, before again sliding back down on the US open. The last 3 hours of trading saw a choppy sideways action on very thin volume heading into a volatile close. Settling the session at almost 565USD/mt, up 4USD/mt on the day. With the raws trading flat, this means the spot white premium widened slightly, and the whites market more broadly remains in a sideways-to-downward