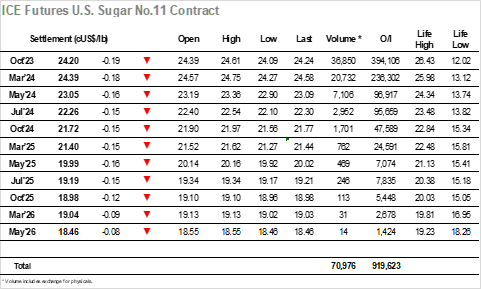

It was a calm start to the day, though within minutes the day traders were attempting to continue yesterday’s movement and further engage the upside with a sharp push to 24.61 basis Oct’23. The hope was that other specs/consumers would follow behind to chase the move, however that was not the case and with no follow-on interest the market quickly retreated towards unchanged. That put the lid on things for the morning with the next few hours seeing the market edge along either side of 24.40, a tedious scenario which is familiar in the European summer with fresh news at a premium. There was a small effort to push the market higher again following the start of the US morning though this ended more abruptly than the early effort with the resultant liquidation sending values down to fresh session lows. The decline continued to 24.09, wiping out all of yesterdays rally, and though some price consolidation followed it was again on lower volume. Spreads were unmoved for another day despite the flat price swings with Oct’23/March’24 continuing around -0.18 points, while March/May’24 sat unchanged at 1.36 points. With the wider macro struggling the later part of the session played out to the lower end of the range, Oct’23 gravitating closer to 24c once again, and area at which it seems relatively content, with settlement made at 24.20.

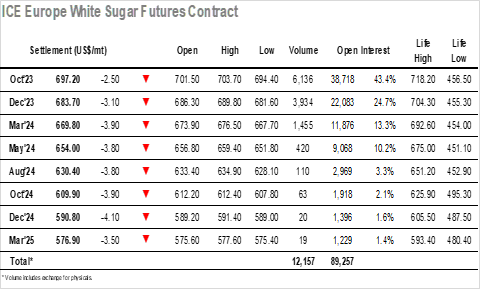

White sugar has made a blistering start to the month and there was a desire to try and continue that trend with the opening seeing prints up to $703.70, however a lack of substance behind the buying meant that Oct’23 soon fell back to unchanged levels. Strength from the grains sector was being attributed as motivation for the upside efforts, though with No.11 values still proving reluctant to rally there was a struggle from the whites to maintain recent momentum despite another strengthening in the Oct/Oct’23 white premium to $163.50. Instead, the price simply worked either side of $700 for the next few hours, the intent to push higher still apparent though becoming more difficult to justify as the wider macro started to weaken with most commodities falling into the red moving into the afternoon. This drew out some more liquidation from the smaller traders / specs to leave Oct’23 as low as $694.40, though overall there was insufficient interest to send the market sharply from the range and prices were left to drift aimlessly. The pattern continued into a quiet close, with Oct’23 ending the day showing mild losses at $697.20.