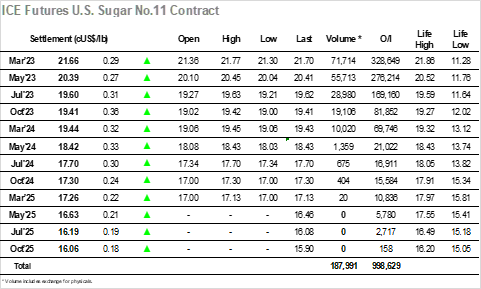

Opening at unchanged the market soon began to attract buying with longs appearing determined to step in and defend the market following yesterday’s modest pullback. This meant holding March’23 just ahead of unchanged levels for a large part of the morning but as confidence increased so too did the buying intent with a little more volume pushed in and sending the spot month up into the mid 21.60’s. Though any producer selling was modest the market topped out in this area and a small correction to 21.50 followed before buyers stepped back in to pick things up for a second time. This second aggressive push took March’23 back up to 21.77, a mere 9 points short of yesterdays lifetime contract high mark and was achieved on still modest buying with longs keen to exploit the lack of resting sell orders to better value their positions. Though the rest of the day was played out within the range there was a constant underlying support which maintained gains, the market eventually closing at 21.66 to remain well poised to push again should the spec/commercial longs wish to try and end the week positively. The only slightly negative connotation came from the March/May’23 spread as it narrowed a little to 1.27 points, possibly a sign of things to come when the index roll gets underway next week.

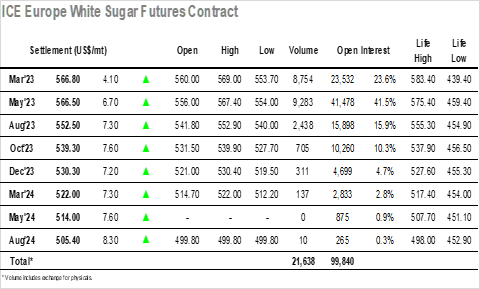

Despite indications to the contrary, we saw a gap lower for London whites on the opening as a continuation of yesterday’s pressure quickly sent May’23 down to $554.00. The lows were only seen briefly but in the process we also saw March/May’23 at a -0.50c discount while the March/March’23 was valued near to $87.00 dollars, placing it some $30 beneath mid-January levels. It took a while for the market to draw breath and a large part of the morning was spent clawing back the losses with support arriving in response to a rally for No.11 values, only bringing the value up through $560.00 just ahead of noon. The recovery led to some corrective action within the premiums from May’23 forward, though the March’23 remained under some pressure. Taking the lead from No.11 the afternoon saw price action play out in net credit with May’23 extending back to a high at $567.40 before stalling as the limited buying quantities further eased. A calmer period ensued until some buying returned during the final hour to pull back upward and ensure settlements within proximity of the highs at $566.80 for March’23 and $566.50 for May’23, though as can be seen this still left the spot spread weaker at just 0.30c premium. Overall, the weakening spread doesn’t send a great signal for the bulls who are keen to maintain flat price strength going forward, though following todays efforts it would not be surprising to at least see some further defence tomorrow to try and conclude the week positively.