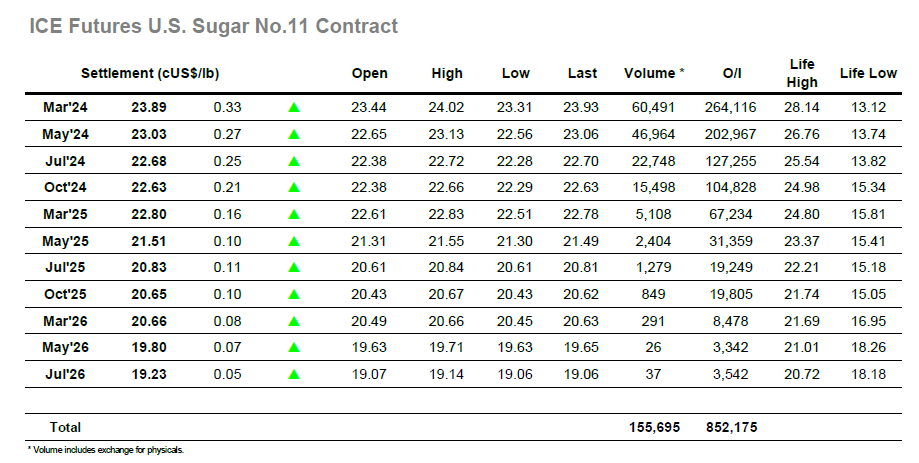

The market was lacklustre during the first part of the morning with prices trading a little lower after yesterday’s weak showing dented confidence. It took most of the morning for March’24 to finally finds its way back into credit but the signs remained generally negative and having topped out at 23.67 the market plunged down to 23.31 against long liquidation. One thing which has been true of the smaller specs recently has been their resilience to continue pressing higher despite the lack of additional support, and so the turnaround which followed during the afternoon was to be admired as once again they pressed ahead. A series of new daily highs were made across several hours, culminating in a brief nudge through 24c and a high at 24.02. This also went some way to reinvigorating the spreads though the gains here were not of the scale seen on previous pushes with March/May’24 only back out to 0.89 points. The market remained to the upper end of the range through into the close leading March’24 to settle positively at 23.89, though with the COT report not expected to show wild movement and the market still well within recent parameters the likelihood is that we see a continuation of the current broad range ahead of the index roll later next week.

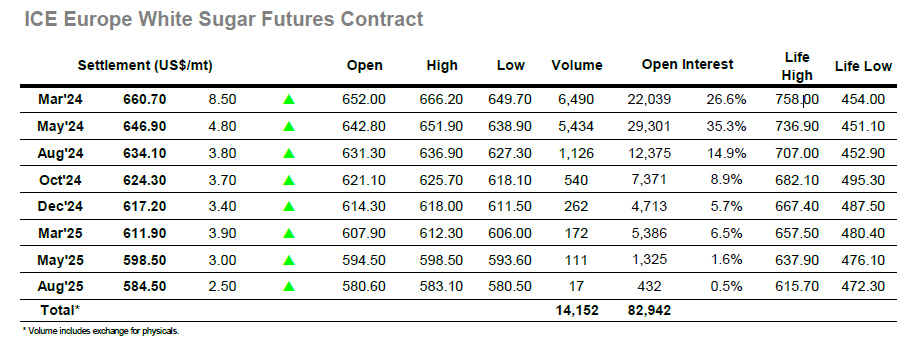

The white’s market has struggled this week and there was no sign that this would change today with the morning spent nudging quietly either side of unchanged on thin volumes. It seemed there was little to reverse this week’s broadly lower trend, however the market did begin to find some supportive interest during the early afternoon, following on the heels of No.11 where specs were again playing the long side. Prices rose steadily across a three-hour period to reach a high at $666.20, and in so doing even the white premium reduced a small amount of its losses with the March/March’24 touching to $137.00. March/May’24 was seeing some steady buying as the roll gathers pace now there are less that two weeks until the expiry, though for the flat price things remained calm due to limited resting orders. From the highs there was some profit taking / position squaring which dropped March’24 back towards $660.00, and the market was unable to recover from this area before the close, leaving the premium back towards its starting point at $134.00 March’24 settled at $660.70, solid gains but still more likely to lead to a continuation of range trading rather than a fresh rally.