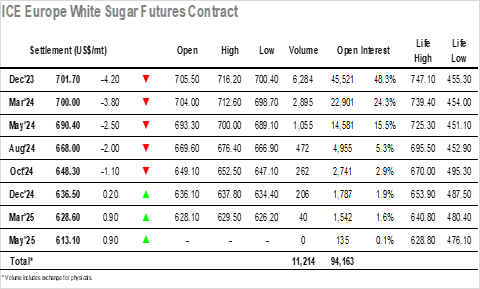

There was some volatility to begin the new month with Dec’23 rallying from an initial low at $704.10 to highs of $716.20 in little more than 30 minutes. This movement had a significant impact upon the white premium values which had commenced the day weakly before moving into credit on the flat price movement, both Dec’23/March’24 and March/March’24 seeing movement of more than $6 across this period. With no continuation of the early buying there was a move back down into the range by mid-morning and from there the picture quietened significantly. There is no fresh news to be found and so it was that the price simply drifted along quietly for several hours, Dec’23 eventually easing back to marginal new daily lows during the afternoon, though driven more by a lack of interest than anything more significant. As we approached the final hour there was a small rally driven by US specs, though the market had scant interest in keeping pace with No.11 which allowed the premiums to retreat towards morning lows, May/May’24 trading back to $119.00. The final hour saw selling return, sending the market out around its lows as Dec’23 settled at $701.70, technically negative with the potential to fill last months gap to $697.60 (unless of course we are to see an island!).

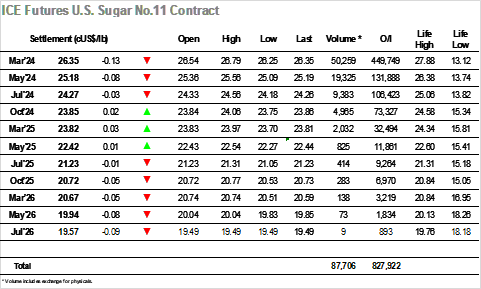

March’24 made a positive start to its tenure as spot month by finding some solid early buying, the mixed early interest from consumers and specs taking the price quickly up to 26.79. This was in keeping with the recent see-saw activity, something which shows no sign of abating as selling returned later in the morning to send the price back down through the range to 26.50The market was finding it difficult to develop any discernible pattern and that maintained into the afternoon when a period of apathy drew in some more light selling and sent the price to a new low at 26.30. Friday’ COT showed an expected small decrease to the net spec long, which now stands at 187,029 lots, and while this movement may have been considered to see a continuation of that trend, the quick turnaround and rally back to 26.72 suggested it may simply be the day traders and algo’s being swung in and out. That theory gained more credence during the final hour as the market took a final turn lower to move at pace to a daily low 26.25 ahead of the close which saw short covering. With no fresh news and little apparent interest in proceedings from the trade this rangebound volatility may continue for the near term, with today’s mildly lower settlement value of 26.35 changing nothing from a technical perspective.