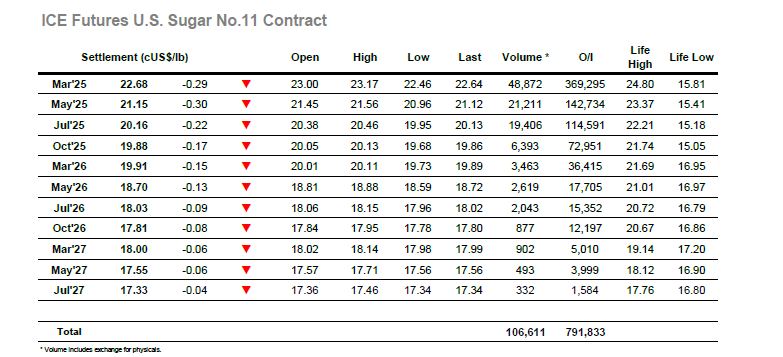

Having recovered to the 23c area the market was on the move again during the opening stages with a push to 23.17, and though the losses were erased by mid-morning as the spec buyers eased away there was another push to follow which brought the price within a tick of the highs late in the morning. Specs would have hoped that this would draw additional buying through, particularly in consideration of a generally positive macro picture, however that was not to be the case and instead the market drew back again to consolidate the 22.90/23c area, awaiting some greater input. That input did not arrive for a few hours, and when it did the movement was contrarian to the activity of oil and the wider macro with prices falling sharply back to 22.46 before digging in to ensure that some of yesterday’s gain could still be maintained. There was a small recovery to 22.60 before consolidation set in, and this endured through to the closing stages when defensive buying from longs arrived looking to minimise the impact of the daily change. Spreads were little changed with March/May’25 falling back from 1.62 points to close little changed at 1.53 points, while the spot was in the red to varying degrees against the rest of the board as yesterdays gains reversed. March’25 settled at 22.68, lower but making little difference to the general situation with physical availability concerns and macro factors still in the mix and unlikely to leave us anytime soon.

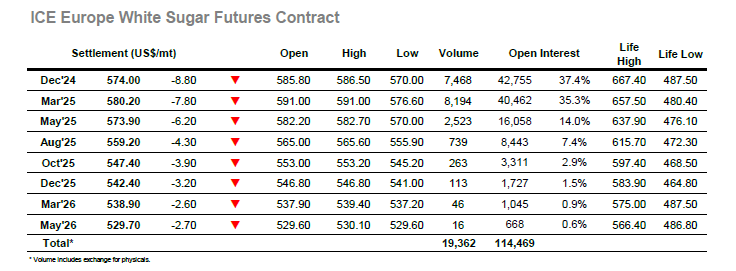

Higher opening prints were fleeting and before long the market had dipped below $580, marking an unconvincing start in consideration of yesterday’s showing. The situation did improve again across the rest of the morning with values returning to a small credit, though volumes were low and there was no test of either end of this early range. That did not occur until the early afternoon, and it was the lower end being investigated as the market disregarded any macro concerns regarding the ever-developing middle east situation to sit in the upper $570’s. With a couple of hours remaining there was a burst of activity which saw Dec’24 plunge quickly down to $570.00 as the lack of upward progress drew some position liquidation, but once this concluded the market resumed its low volume drift, only this time with the price returned to the lower $570’s. There was familiar vulnerability being shown for spreads and arbs as the price fell with Dec’24/March’25 moving to -$6.90, while the March/March’25 white premium saw intra-day lows beneath $80. There was a small upturn in Dec’24 values heading into the call which reduced the losses to a close at $574.00, leaving the wider picture broadly unchanged.