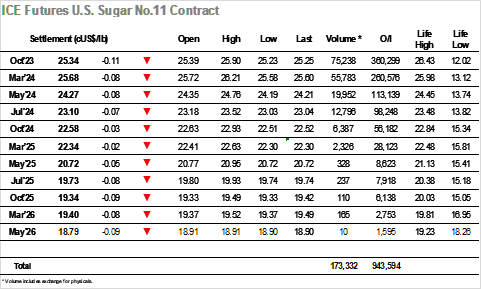

Today No.11 market opened at 25.39, 6 points below yesterday’s settlement. The post opening was marked by some push towards 25.80, which was reached 9h45am. From 10am to 1h30pm, market traded sideways, absorbing some correction, trading between the 21.60 and 25.75 range. At 1h30pm, bigger volumes raised No.11 prices, making market recover opening levels and touching the daily high at 2h30pm, trading at 25.90. Past daily high, market was able to maintain that levels for approximately half an hour, but a selling wave soon started. There was some liquidation 3h30pm that brought No.11 back to 25.52. During the next hour further selling took place and market went down, trading below opening level. In the last trading hour, market traded sideways around 25.50 then collapsed 25 points in the last 10 trading minutes, closing near daily low, negotiated at 25.25. Settlement price was 25.34, a -0.11 move from previous settlement (-0.43% change). Volume traded was 75k lots and V3/H4 spread closed at -0.34 (-0.3).

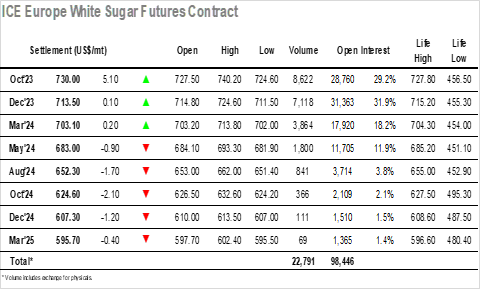

Today Oct’2023 opened at $727.5, $3.4 above yesterday’s settlement. In the beginning of the trading session, strong spike candles raised market to $730. Lateral movement was then seen a little above these levels, with market trading around $731. The situation changed 1h30pm, when considerable buying volumes started pushing the market up. At 2 pm, prices touched $736.5, and a further price push was seen in the next hour until daily high ($740.2 at 3h30pm). From daily high until closing, there was some liquidation. Near 5pm, market was trading back to $729.7. The last trading hour of the session drafted some recovery, to the $734.5 zone but in the last 10 minutes market collapsed back to $728.5 at closing. Settlement price was $730, marking a +$5.1 (0.7% increase from previous settlement). Volume traded was 8.6k lots and V3V3 white premium closed valued at 169.86, +$6.1 up move.