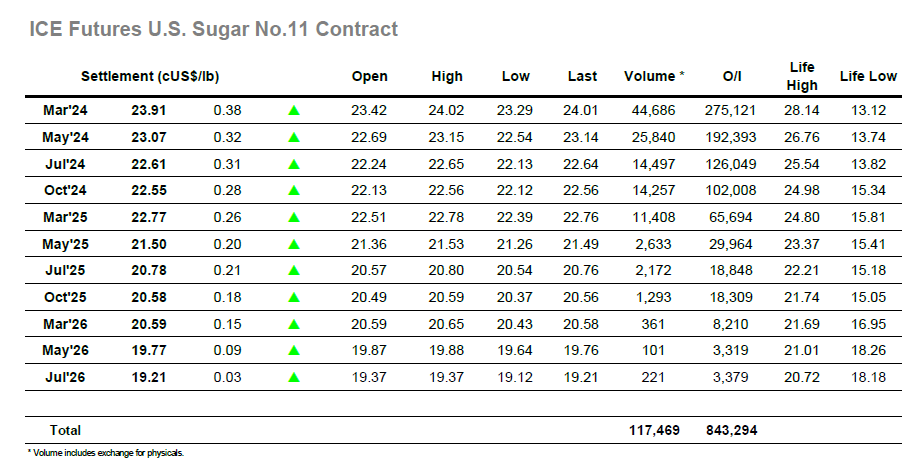

March’24 was pushed down to 23.29 on the opening as traders continued to exert pressure, however the fall proved to be brief, and it was not long before the losses were retraced, and values were sitting with little change. This paved the way for a very quiet morning spent either side of 23.60, and with no news to speak of the market remained similarly slow into the afternoon with no apparent interest coming from the US specs to enliven proceedings. Some excitement did arrive with a short, sharp spike to 23.82 that failed to garner additional support, but overall, it was proving to be a tedious affair from which most potential participants were happy to stand away. It was only during the final two hours that the market took on an interesting appearance with buyers generating the direction, and on this occasion, there was sufficient continuation to prevent against another failure. March’24 pushed first to 23.92 and then through 24.00 on the post-close, a solid showing in the context that white sugar was showing no desire to follow suit, though this factor will also raise a flag as to the validity of the move. March’24 settled at 23.91 with nearby spread values positive, a steady recovery as longs try to fight back following the recent pullback though with questions still in place as to the longer-term sustainability of the upside.

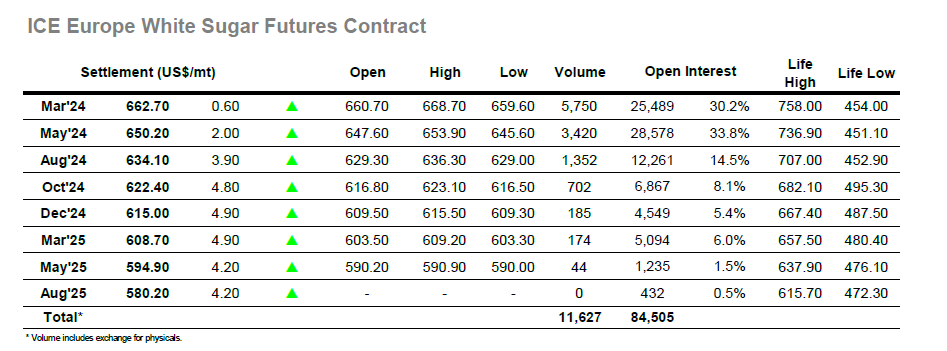

The market responded reasonably well to yesterday’s fall with a calm start which saw prices near to unchanged levels through the first hour, and from this base March’24 was able to nudge upward across the rest of the morning to reach $666.40. There was no continuation interest and so prices fell back towards unchanged levels once more with all seeming set to remain quiet until reaching the early afternoon. Some volatility then arrived to widen the range in both directions (low $659.60 / high $668.70) as prices swung back and forth against small trader / spec movements, though the thin liquidity aided this considerably with little resting in either direction to slow the movements. Only the spreads served to bring values to a more respectable level as rolling continues ahead of next months March’24 expiry, though the spread itself also held a range and was centred around $13-14 in the main. The final couple of hours proved fascinating. With the market reaching its daily high in conjunction with spec buying of No.11 but then proceeding to disconnect. This left an already weaker March/March’24 white premium value to collapse from the lower $140’s to $135, a sharp reverse from its recent path and one which casts additional doubt on the ability of the market to sustain higher levels. March’24 settled marginally higher at $662.70 following the shenanigans with no reason to believe that substantive support should return presently.