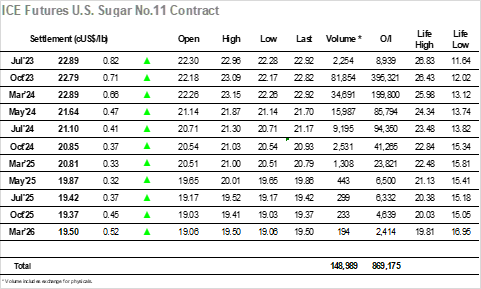

A mildly firmer opening quickly became a far stronger start as Oct’23 built from 22.17 to be trading at 22.61 within the first 30 minutes. The buying was mostly emanating from consumers while there was also some short covering mixed into the activity as traders unwind recent positions, though once much of the physical volume had been covered the market cooled with a retreat to the 22.30 area. A consolidation pattern then developed in this area which maintained into the afternoon, providing some encouragement for longs with the early afternoon having recently represented the point at which the large losses have kicked in. With the market not falling we instead saw a fresh push higher with volume coming from a variety of sectors, though spearheaded by smaller specs and consumers. Their first push saw Oct’23 move to 22.78 with a second round of buying extending the price to 23.09, a mighty 1.01 points above last night’s closing level, marking impressive gains albeit aided by a lack of any selling from producers. As some long liquidation/profit taking began to show there was a cooling of prices back down through the upper end of the range where we remained through the final two hours. Some choppy trading on the close led Oct’23 to settle at 22.79, breaking the cycle of lower days though with much work to do if the recovery is to sustain. Tonight’s Jul’23 expiry is expected to see 8,118 lots (412,415t) tendered, with the Jul/Oct’23 spread having expired at 0.10 points premium. The formal exchange notice providing full details will be issued on Monday.

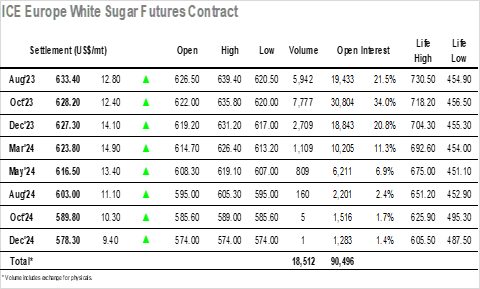

The lower levels have been inspiring a greater volume of consumer buying over recent days, and the latest such buying had a significant impact this morning with Oct’23 trading more than $13 higher during the early stages to reach $629.50. The price cooled a little once the initial buying flurry had concluded, though the gains were partially maintained with the market consolidating the lower $620’s through the rest of the morning. A little more pressure was applied during the early afternoon, but unlike recent sessions the support held form and so from a low at $620.00 the market was able to build and work back towards the morning highs. Alongside the flat price recovery there was a solidity about the spreads with the Oct’23 positions holding steady, though gains down the board meant that gains were only moderate versus the 2023 prompts, while at the very top of the board Aug/Oct’23 had widened out to $8.90 during the morning before slipping back to overnight levels. With sellers few and far between the market continued to build during the afternoon with Oct’23 reaching a high at $635.80 before edging back against day trader profit taking. The final part of the session played out near to $630.00 basis Oct’22, with MOC selling leaving settlement at $628.20 to conclude a day of recovery.