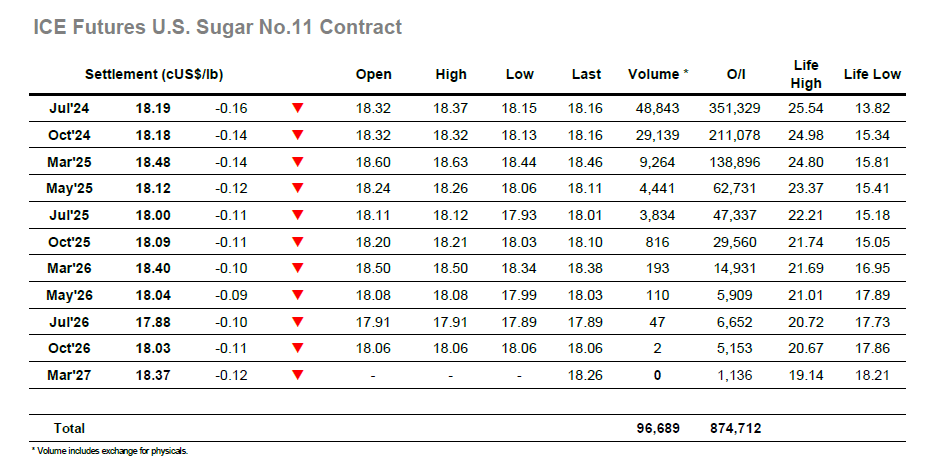

Today’s trading has been mostly uneventful, even by recent standards. For the first few hours after open, Jul’24 raw sugar futures hovered around yesterday’s settle, unable to break much higher or lower than 18.3c/lb on extremely thin volumes. The one ‘highlight’ of the day arriving shortly thereafter came in the form of an almost 2k lot move by sellers, forcing the market quickly down to 18.2c/lb, before meeting stronger resistance and reversing all the way back to where it started. From then until close, on slightly better volumes prices look to have edged lower, breaking back below 18.2c to settle at 18.16c/lb. This puts prices back at the bottom of the recent 18-19c/lb range, should it fail to hold this time, things could become more interesting.

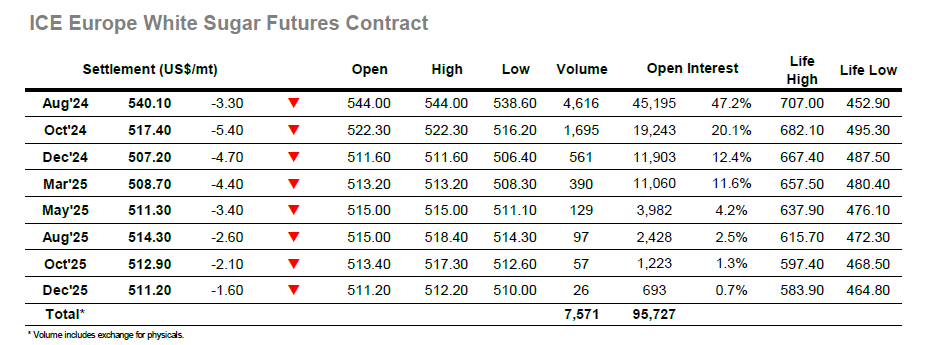

Aside from the open (gapping down almost 4USD/tonne) it was a fairly uneventful day for the whites market too. For the majority of the session the Aug’24 white sugar futures yoyoed around 539-544USD/tonne on mostly quite low volumes, broadly following similar moves over on the raws. Volume did pick up slightly into the second half of the day culminating with an almost 400 lot move sharply down into close, with the settle of 538.8USD/tonne almost representing the low of the day set a few minutes earlier. This late move means the Aug/Jul’24 white premium continues to contract, breaking back below 138.50USD/tonne.