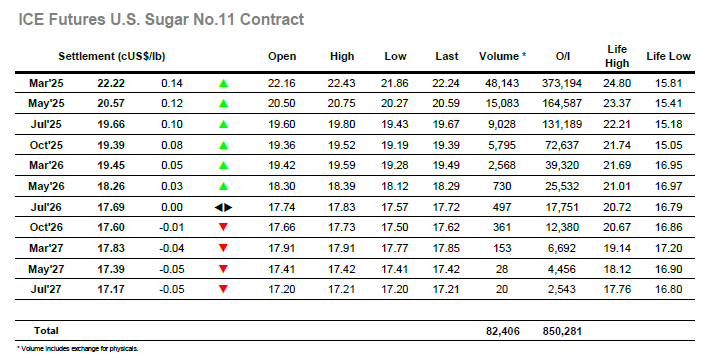

The No.11 Mar’25 contract opened almost 20 points higher today, trading as high as 22.43c/lb within the first 15 minutes and on the best volume of the day. By 10am London most of these gains had been given back, and by midday prices had gradually eroded further, breaking back below 22c/lb. This trend continued into the afternoon, reaching the day’s low of 21.86c/lb shortly after the US open. The remaining hours of trading saw some recovery with prices climbing back up into the close, finally settling at 22.22c/lb. This marks another day of minimal inter-day movement, with the market only moving a net 20 points higher since the start of the week. Volume on front month reached almost 43k tonnes, nearly 50% higher than Tuesday, whilst the HK spread gained 2 points to settle at 1.65c/lb.

A brief spurt of buying on open saw the No.5 Dec’24 white sugar futures reach the day’s high of almost 573USD/mt within the first 15 minutes. From here proceedings quickly turned a corner, with the strong selling see prices tumble 8USD/mt within the next hour, and a further 3USD/mt over the rest of the morning session to see the day’s low of 562USD/mt. Like over on the raws, the afternoon was mostly positive, with prices gradually strengthening back toward where they started the day. Settlement was reached at 569.2USD/mt, slightly up on the day and allowing the HH5 WP to strengthening back over 87USD/mt for the first time since last week.