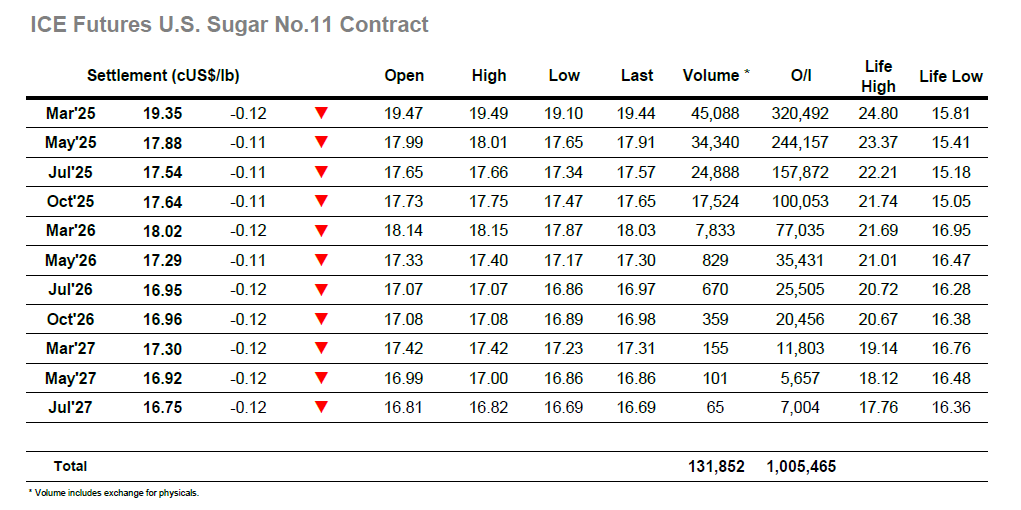

Starting the day at unchanged there was very little interest from either side, though on the light volume that did trade it was sellers in the ascendancy as they capped the market off around overnight levels. This in turn drew additional light selling which nudged the March’25 contract down to 19.29 by the middle of the morning, although the movement was still based upon low volume and so meant little in the scheme of the broader direction. The Americas day enlivened the dull environment as fresh selling appeared to increase the pressure on prices and send March’25 down through the teens before some shot covering halted the decline. The market looked lower on further occasions, but each time met with the same outcome based on day trader covering, such was the lack of interest from other sectors. With the flat price trading lower there were also losses recorded for the March/May’25 spread with a daily low value seen at 1.42 points, though this still represents significant gain over the last seven sessions and is a firm value to take into February ahead of the index roll. Buying reappeared at the top of the board through the final 30 minutes to limit the losses and achieve settlement values for March’25 at 19.35 and 1.47 points for the spread. Overall, the market remains firm despite failing to move beyond Mondays 19.58 mark through the rest of the week, ahead of tonights COT report which will show the level of short coving performed on the rally and allow an informed view to be made of the next steps.

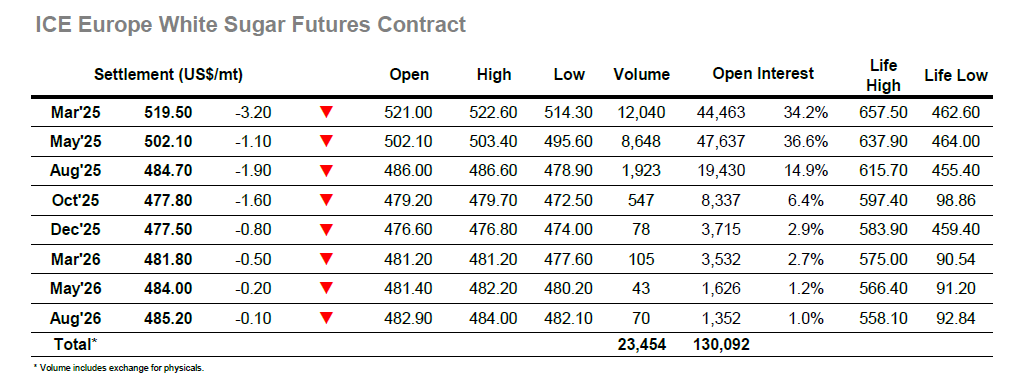

Lower opening trades for nearby positions soon drew in additional selling to place the market under some pressure through the early stages. March’25 slipped by more than $5 to $517.20 within the first hour of trading and then continued to meander with a downward bias through the remainder of the morning on low volume. There was some brief respite early in the afternoon as March’25 pulled back above $520.00 but the supportive interest of recent sessions as lacking and so a tired looking market slipped back down to make new session lows. Through the middle of the afternoon a low mark was recorded at $514.30 before some short covering pulled the value back into the range where it continued to flip about for the rest of the session. These movements were causing the March/March’25 white premium to swing around with a daily range between $91.50 / $94.50, while for the first time in more than a week there were lower prices being seen for the March/May’25 spread as the trade buying was met with rolling. The spread made up more than half of the spot volume as interest faded from the flat price through the afternoon, only picking up during the later stages as defensive buying ensured a March’25 closing value at $519.50. This still leaves the market positioned well despite seeing lower highs for the first time in more than a week, with the spot and spread sure to remain the focus next week as the expiry draws nearer.