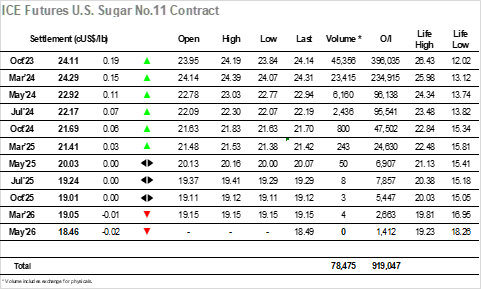

Friday’s retreat to sit beneath 24c once again provided an opportunity for buyers with some weekend physical activity bringing hedge lifting into the market as we resumed. This buying helped Oct’23 up to 24.16 during the first hour of trading, though once concluded the momentum was lost with prices simply drifting within the range for a period. Last weeks COT report showed the net speculative long growing to 144,299 lots, however volumes have diminished since that report with the market slipping, and with the spec buyers having retreated the market is finding it tough to generate significant momentum. This became apparent around noon as the market fell back to test Friday’s lows, the move taking Oct’23 just beneath with trades at 23.84 before short covering pulled values back up. There was very little activity of note as prices continued to swing around the range through the afternoon, with only spread activity pulling the volume up to moderate levels. Some late selling looked set to leave the market little changed, however there was a final twist with longs pushing aggressively into the close to settle Oct’23 at 24.11 with a broadly sideways trajectory remaining the likely path.

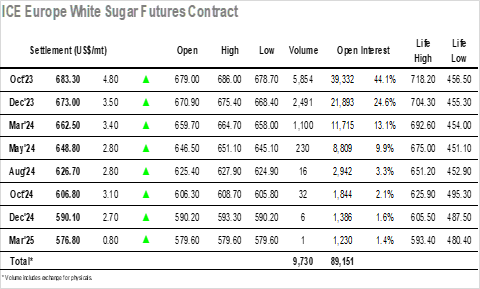

There was some early strength as hedge lifting / consumer pricing pulled Oct’23 up to $685.70, however the market then cooled with a lack of any other buying interest allowing values to hold within the early range. By late morning, the gains were being erased with Oct’23 sitting back in the upper $670’s, though the sense of apathy which so often descends upon the market during the summer meant that there was no additional pressure being applied. Instead, it was the upper end of the range that was tested during the afternoon with a marginal extension to $686.00, remaining at the upper end of the range to extend the Oct/Oct’23 a little further to $155.00. An otherwise uneventful afternoon concluded with some late day trader volatility, resulting in an Oct’23 settlement at $683.30 to bring an ‘inside day’ to a close and potentially set the tone for additional rangebound trading over the coming days.