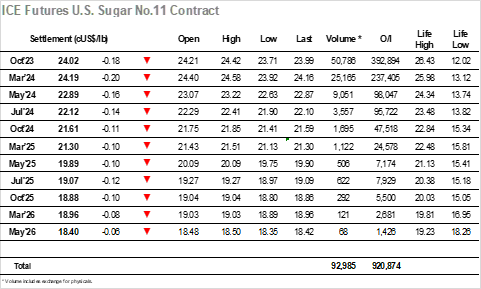

There was another positive start for No.11 today with Oct’23 finding light but steady buying through the first 90 minutes to trade back up to 24.42. The ongoing issue remains that there is insufficient news to inspire any buying interest from the funds or trade which may continue the higher moves, and so an inevitable pullback on long liquidation sent Oct’23 back to sit in the lower 24.20’s. Fresh movement was to follow during the early afternoon and it represented a change of approach from the smaller specs as they turned attention to the downside to see whether a move lower could generate them some momentum and opportunity. Buying remained light ahead of 24c and while there was a touch more support to be seen as we moved nearer to the recent 23.84 low the market still felt vulnerable. This area was tested and breeched by mid afternoon with prices working down into the stronger underlying buying but extending the recent band down to 23.71. Spreads were again largely unaffected as we continued towards the bottom of the range, the picture remaining weak until the final hour sparked short covering and a sharp rally back above 24.10. The closing stages saw calm return with Oct’23 chipping along either side of 24c before closing at 24.02, bringing another day to a close with the market no closer to finding a path out from the broad range that has prevailed for the past month.

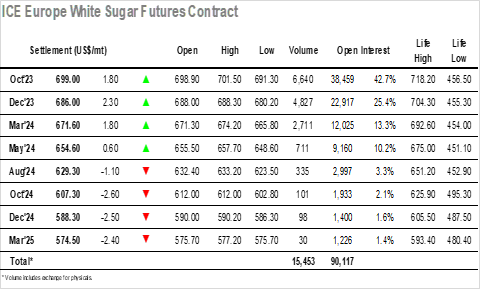

It was a familiar scene for the market this morning as Oct’23 chopped back up above $700 during early trading before falling back to sit near to overnight levels on low volume. The only movement seen was coming from the Oct’23 spreads, and it will not have pleased the bulls to see Oct/Dec’23 softening with trades back to $11.70 by late morning. Pressure continued to be applied to the front of the board through the early afternoon and sent Oct’23 to a low at $691.30, though an impressive turnaround then followed with prices moving back towards unchanged levels despite continuing weakness for the No.11. This led to the latest widening of white premium values with Oct/Oct’23 soaring beyond $172.00 and March/March’24 touching $139.00, incredible strength in the context of the wider environment. The buying continued to take Oct’23 within 0.20c of the morning highs, and while there was some late selling which sent Oct’23 back by a couple of dollars to settle at $699.00 it remained a strong performance overall.