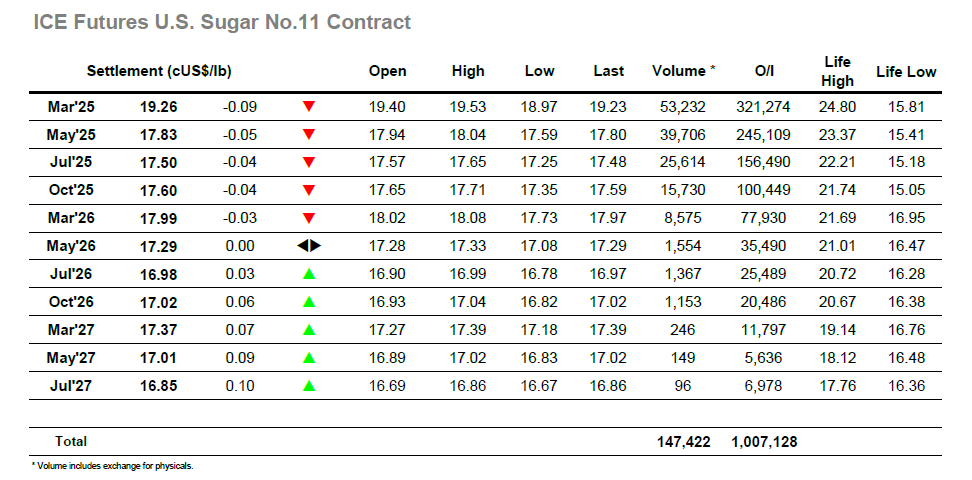

The new week got underway positively with March’25 making an opening jump to 19.53, though the gains proved to be short-lived. Instead, there was a rapid retreat to the 19.20 area as selling kicked in and in a repeat of the action during the second half of last week the market was continuing to be on the back foot with little upward momentum. The COT report on Friday showed only a small 4,428 lot reduction of the net spec short to now stand at -136,417 lots, a far smaller reduction than had been generally expected given the scale of movement across the reporting period and showing how the funds remain content to hold their shorts despite the rally with only the smaller traders generating current activity. This will have encouraged the short push through the morning which saw the flat price drop to 18.97 with the feeling being that buying has dried up unless the funds cover, though having reached the lows and with the day traders loaded up there was a recovery against their own short covering which erased the losses and briefly took prices back to a small credit. Alongside this movement there were also some swings taking place for the spreads where March/May’25 dropped back down to 1.37 points intra-day as the relentless buying of recent sessions eased up ahead of the index roll which gets underway later this week, though it moved back to 1.43 points at the end of the session. The flat price moved back from the highs to sit in the 19.20’s through the final hour and close at 19.26, a lower value but one which changes nothing in broad terms as the market continues to look for some fresh direction having become caught within a 19.00/19.50 band.

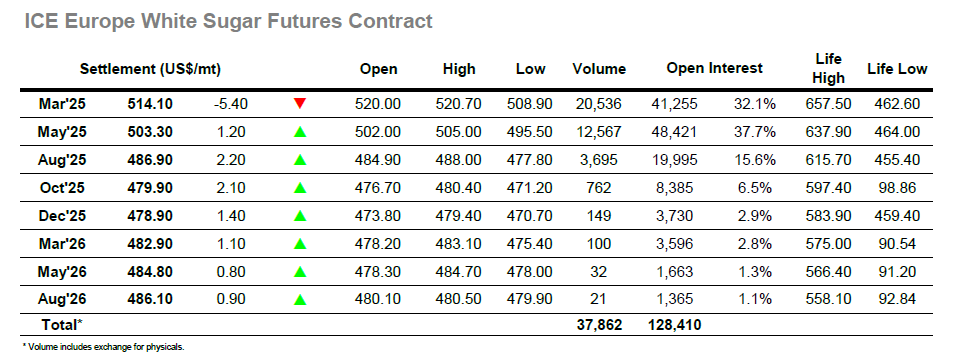

As March’25 approaches expiry the flat price focus has moved towards May’25 which today saw an unchanged opening quickly break down with trades as low as $496.40 during the early stages. Some stability in the upper $490’s followed through to the middle of the morning however there was limited continuation from the buy side and so prices softened once again to sit near to the early lows and make new session lows at $495.50 as the market continued to drift. The fall was being largely driven from the top of the board where the March’25 spreads were attracting selling which tippled through the nearby prompts, though its main damage was inflicted upon March/May’25 as the spread plunged back towards $10.00 without the supportive buying found on the recent squeeze. Despite the general lack of flat price interest, the market turned around quite sharply during the afternoon and rallied through to eventual highs at $505.00 on short covering and fresh day trader buying, with most other entities having limited involvement with January having provided better hedging opportunity than current levels. This rally only brought limited relief to the March’25 spreads which remained subdued, though it did allow the white premiums to recover with May/May’25 moving positively towards $110.00 having earlier sunk to the $105.00 area. :ate afternoon proved quieter with the market edging along calmly into a close which saw most positions showing mild gains but March’25 still under pressure leaving May’25 settling at $503.30 but the March/May’25 spread well down at $10.80.