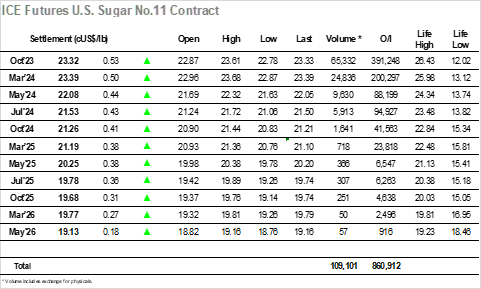

The market started strongly with a surge through 23c for Oct’23, last Friday’s rally clearly not deterring buyers from continuing to chase higher, possibly believing that they may have missed an opportunity to buy at the bottom. With the initial flurry of buying concluded things did begin to settle down and the rest of the morning becoming somewhat calmer with a pullback to unchanged levels before returning to the 23c area ahead of the US morning. Friday’s COT report had shown an expected reduction in the net speculative long position to now stand at 141,425 lots, suggesting that some of the longer standing fund longs had taken profits on the way down alongside the more recent positions also being discarded. Some of the faster moving specs will no doubt have been re-instating longs both Friday and today, though it could well be that the live position is still lower than that reported given the scale/volume of the fall that continued to last Thursday. The renewed buying during the afternoon saw Oct’23 climbing all the way back to 23.61 on modest volume, producers remaining absent from the market at current levels, before a drop back to the 23.40 area later in the day as some profit taking kicked in. The market lost a little more ground during the closing stages to settle at 23.32, another solid showing as longs look to continue reversing the recent sharp fall.

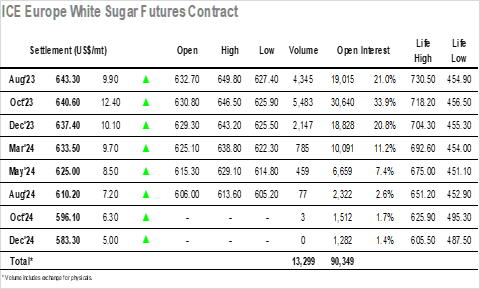

Early trading saw Oct’23 trading either side of unchanged levels, and with a modicum of confidence restored following last Friday’s performance the market continued trying to look higher as the morning progressed. Highs were reached at $642.00 before falling back to the mid-$630’s around the time that the Americas day was getting underway, impacting the nearby white premium values with Oct/Oct’23 back into the mid $120’s having briefly nudged above $130 earlier in the day. Once any Aug/Oct’23 spread rolling was discounted from consideration there were relatively disappointing volumes changing hands for the scale of movement being seen, with the afternoon push up to new session highs of $646.50 made largely against spec buying of No.11 with the white premium value keeping pace. Aug/Oct’23 was meanwhile experiencing another see-saw session within its recent range, trading between parity and $5.20 premium, though sitting near to $2.00 later in the afternoon. Some selling/profit taking from day traders arrived later in the afternoon to send values back by a few dollars from the highs, though the overall tone remained positive leading to solid double-digit gains for the day with Oct’23 up by $12.40 at $640.60.