Following on from the strong market performance yesterday afternoon the market slipped back into consolidation mode, a familiar pattern over recent days with the nearby prompts softening through the early hours before picking up interest once the Americas have come online. Having spent most of the morning in the 20.50’s the arrival of US specs initially made little difference, though as time wore on some light buying interest did emerge to push Oct’24 back up to 20.73. This mark was just 5 points shy of yesterdays recent high, but the substance was lacking with from the long side and so following a period stalling around 20.70 there was day trader liquidation to send us back down through the range. This placed a little more pressure onto the Oct’24/March’25 spread, with recent gains slowly eroding as the value dropped back to -0.32 points discount. Trading remained broadly sideways through the final couple of hours, though a little selling did emerge for the call to cement single digit losses at the top of the board with Oct’24 settling at 20.53 heading into tomorrow’s market holiday.

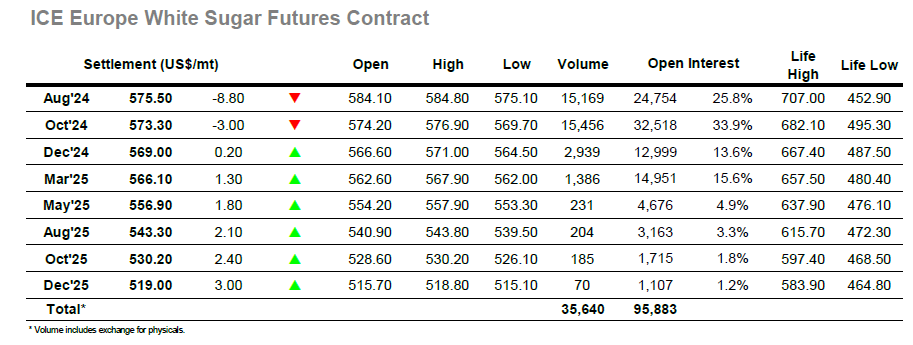

Oct’24 saw quick losses again this morning with the price washing out back to the lower $570’s on light volumes, with buyers few and far between. It was noy just the Oct’24 contract under pressure with the soon to expire Aug’24 taking even heavier punishment, further narrowing the Aug/Oct’24 spread. The status quo maintained for several hours, and new lows were recorded at $569.70 early in the afternoon before some positive movement arrived in the form of short covering. Sch was the lack of selling that the market easily pushed up to $576.90, a mere $0.10c shy of yesterdays recent high, though with scale selling then starting to emerge and fewer willing buyers another pullback into the range followed. Total volume was good, though this was solely due to the Aug/Oct’24 roll which made up around 70% of the total across the front two positions, and the rolling maintained the pressure upon the differential with narrowest trades at $2.00 late in the afternoon. The flat price meanwhile ticked towards the close around the centre of the range, ending at $573.30 to remain within striking distance of recent highs.