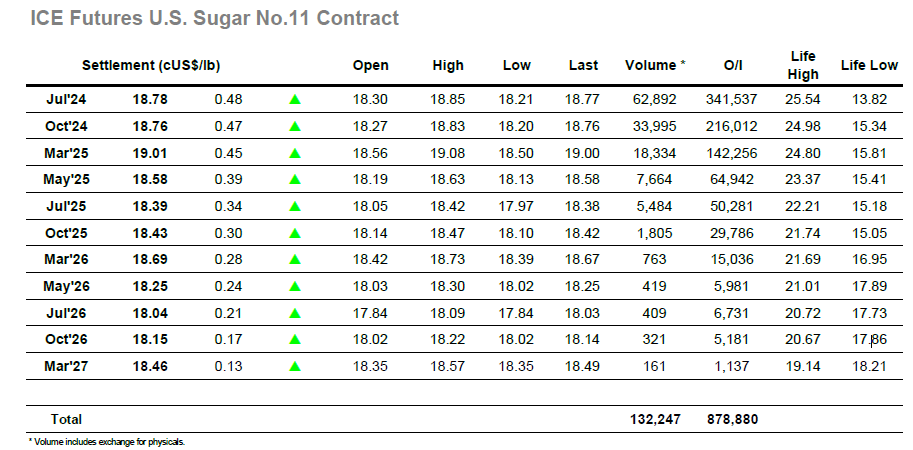

Resuming after the weekend, the market was still lacking any significant news to provide fresh impetus with only the marginally reduced net short from the latest COT report (now standing at -81,479 lots) providing any fresh colour. The market duly reacted in a non-plussed way with little change seen through the early stages, suggesting that there is no end in sight yet to the current malaise. Small gains were consolidated with Jul’24 holding the low 18.40’s through the late morning, and by early afternoon with the arrival of Americas traders some additional momentum started to generate. The buying was mostly spec driven, whether from day trader/algo longs or short covering, and with sellers remaining few within the range there was a path to the 18.70’s available which the buyers willingly took. Recently it has been the 18.80 mark which has provided the top, and this area again signalled the start of some larger pricing orders down the board and slowed the rate of rise, though Jul’24 did at least extend to 18.85 representing the highest level since mid-May. Pre-close profit taking by day traders knocked values back a little heading into the call though settlement values were solid with Jul’24 at 18.78. Whether this can provide the catalyst to break from this range remains to be seen, though the smaller/momentum traders will undoubtedly be determined to try as they search for fresh opportunity.

The whites market has been caught within a $535.00/$555.00 band for the past couple of weeks, and there was no sign that this would change during the early part of today’s session with Aug’24 chopping around the lower $540’s. A small rally to the $546.00 area followed during the morning and the market was able to then consolidate this area on low volume through until noon. This ‘centre-range’ position was providing little indication as to the next move, though by early afternoon it became apparent that specs were looking to test the upper part of the range again having held the lower part late last week. Their efforts saw the price push back into the lower $550’s in quick time, and in the process widen the Aug/Jul’24 white premium back above $141.00, though it became apparent that above $550 progress would remain trickier. In the event we saw the range extend to $554.00 during the final hour though it had been a determined grind to get this far with the price still 0.80c shy of last weeks highs. Still, this does provide an opportunity to continue pushing ahead should the specs wish, and despite some end of day position squaring the market managed to post positive settlement at $552.30 for Aug’24. Nearby spreads were marginally weaker as Aug/Oct’24 settled at $21.60, while the Aug/Jul’24 arb had dropped back to $138.25 to show little change.