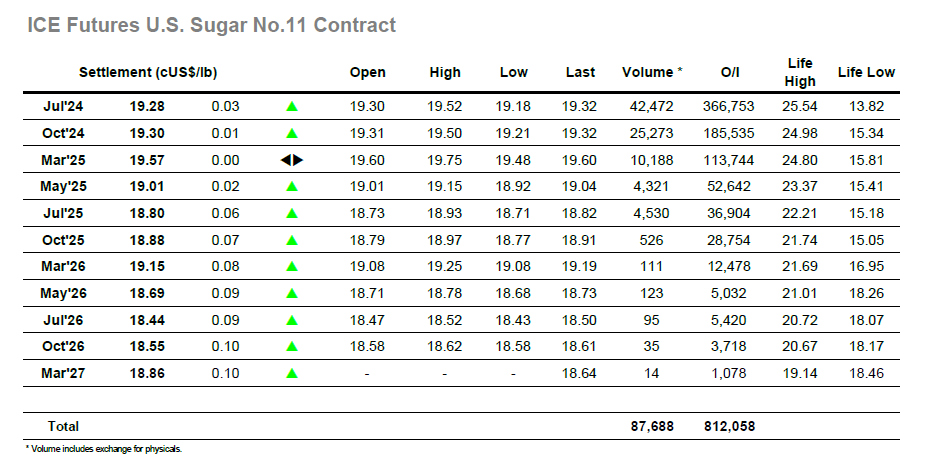

The market showed only slight change though the first hour on limited volume, though following this we saw that day trader interest was keen to get going and there was a push back up to the 19.40 area. Rather than inspire an additional rally the market simply flatlined for the next couple of hours, with those participants that were showing an interest having to sit back and wait for the Americas day to generate additional movements. There was a small amount of fresh buying which did appear and this too Jul’24 up to 19.52 before stalling, but that aside there was little to offer from any corner of the globe and the latest in a series of tedious sessions continued along. Jul’24 worked either side of 19.40 with no intent until the final hour, and here the price only appeared to fall due to some pre-weekend position squaring. The final stages played out near to 19.30 with Jul’24 reaching settlement a mere 3 points firmer at 19.28. Monday sees a shortened session while the London whites are closed for a holiday, though whether that will provide any opportunity for No.11 to break the current monotony remains to be seen.

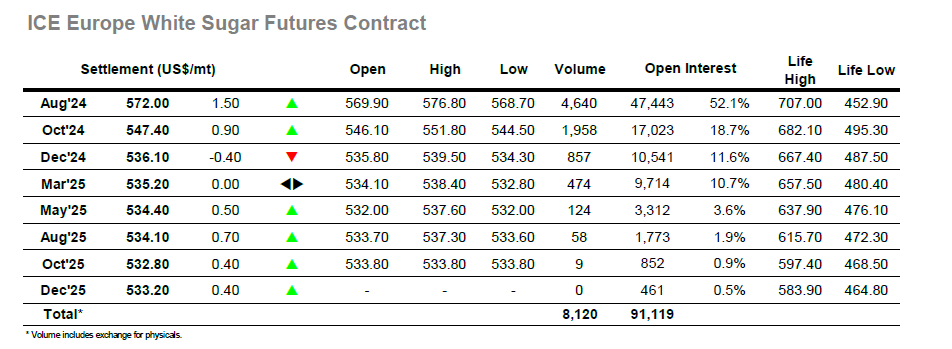

There was a marginally lower start for Aug’24 and lows were recorded at $568.70 as the market struggled to attract much interest. This lack of movement then drew some light buying back to the environment with longs able to make some easy gains, and the price soon pushed ahead to the $574.00 area where they could hold comfortably to maintain the recent front month stability. It was only reaching the afternoon that any more movement was seen, and inevitably it was the long side which again found the interest with a couple of nudges upward yielding a high at $576.80, just $1.10 shy of the 3-week high. Aug’24 whites continue to stand alone from the rest of the board/sugar world with spreads having widened and the Aug/Jul’24 arb above $147.00, and this factor will have played a part in the move stalling as continual gains will prove difficult if “flying solo”. Instead, most of the afternoon played out within the upper half of the daily range with the price only falling back further during the final hour. Modest gains were maintained as Aug’24 settled at $572.00, while Aug/Oct’24 closed at $24.60 and the Aug/Jul’24 arb was valued $146.95 heading into the 3-day weekend.