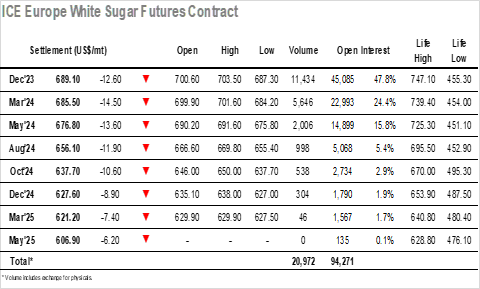

A marginally lower opening was merely a prelude for the market to move sideways, sitting just above $700 through the morning for Dec’23 on such low activity that it was difficult to tell whether the market was actually open. A little selling was seen around noon to fill more of the August chart gap though the start of the US morning then drew some light buying and a small bounce into credit at $703.50. It was becoming increasingly clear that the spec appetite to buy has not yet returned as a slide down to $697.30 which filled the gap failed to see any support materialise, instead drawing out further selling / liquidation to increase the pace of the downward movement. Over the rest of the afternoon the market tracked down through an assortment of scale buying from consumers, ensuring that strong daily volumes were seen despite the inauspicious morning activity. The decline led to a low at $687.30 later in the afternoon with the market spending the final hour glued to the bottom of the range, and with no buying being found aside from the scale activity tonight’s close at $689.10 may be a stopping point on route to further near-term losses.

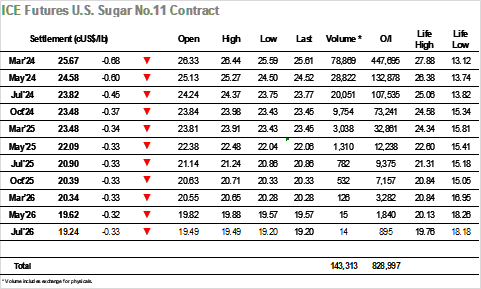

Recent struggles have left the market showing some vulnerability, although the nature of yesterday’s performance on the back of a record delivery suggested that the wider EL Nino concerns were offsetting the negative connotations. Today’s session began calmly with morning trading holding a tight range either side of 26.30, the specs showing little interest in proceedings with the lack of direction making them reluctant to commit to anything. It was not until we moved into the afternoon and the arrival of Americas traders that any movement was seen, with day traders looking to move the market to both directions and generate some opportunity but little else. By mid-afternoon, this situation changed with a slide to the lowest levels since 1st September, filling in consumer scale orders along the way as speculative long liquidation combined with opportunistic algo selling. The slide paused ahead of 25.80 but there was to be another kick lower late in the afternoon and by the close March’24 had reached 25.59. Settlement was made only a small way above this mark at 25.67 following the usual arrange of position squaring, leaving the market appearing vulnerable to additional near-term losses due to a lack of immediate support from the charts.