It was a subdued start to the session with buyers more reluctant to show and across a slow couple of hours the price drifted lower with trades at 22.39 for March’25. With no impetus being shown to move the market very far there was a gradual recovery through the later morning, however the impression being given was one that would see continuing apathy. This proved incorrect as the US morning brought some livelier interest from the specs, though progress was a little more spectacular than the volume really merited with the current parameters failing to draw in much selling. A second push higher followed and sent the price on to new weekly highs, and on this occasion, there was a little more substance to the push though it topped out at 23.34 with the higher levels finally uncovering some resistance in the form of grower pricing. A firm macro was likely behind the push and buoyed by the strength there was a determination amongst longs to hold prices above 23c through the rest of the afternoon and bring the technical picture back to the positive. Nearby spreads were higher in recognition of the spot buying with March/May’25 hitting 1.72 points intra-day. Protective buying into the close ensured a March’25 settlement at 23.24, above yesterdays highs and with the potential to continue upward ahead of the weekend.

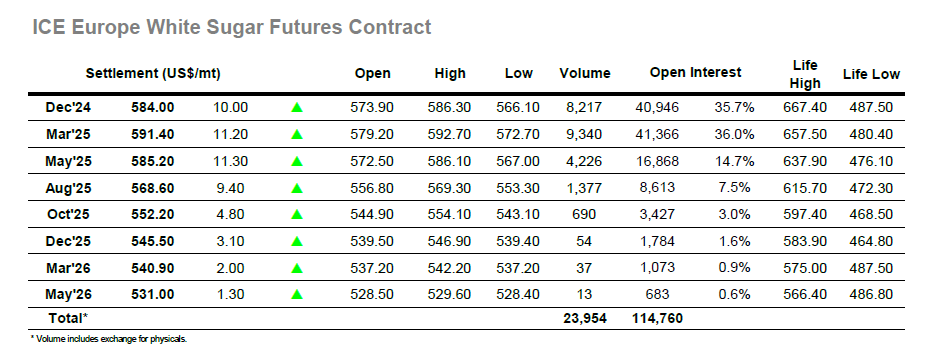

Confidence remains lacking for the whites as demonstrated by the slide to $566.10, coming in conjunction with the wider sector but at a greater pace than No.11 to again narrow the March/March’25 white premium. A small recovery followed as the morning progressed with the price levelling out in the region of $570.00, but the rally which then developed, fuelled by activity from US specs in the No.11 came as a surprise by quickly sending the market price to a sizable credit. Highs were ultimately recorded at $586.30, but with the strength being shown elsewhere these were largely maintained as a new trading band developed across the final three hours. The market still lagged behind with March/March’24 down to $77.50 at one stage, though a small recovery followed and by late afternoon it was back in the $79 area. Dec’24/March’25 meanwhile was a touch weaker with the spot struggling to attract interest and ended the day at -$7.00. Dec’24 saw light movements around the close as it settled $10 up at $584.00, marking a strong gain despite the whites still feeling a bit heavy.