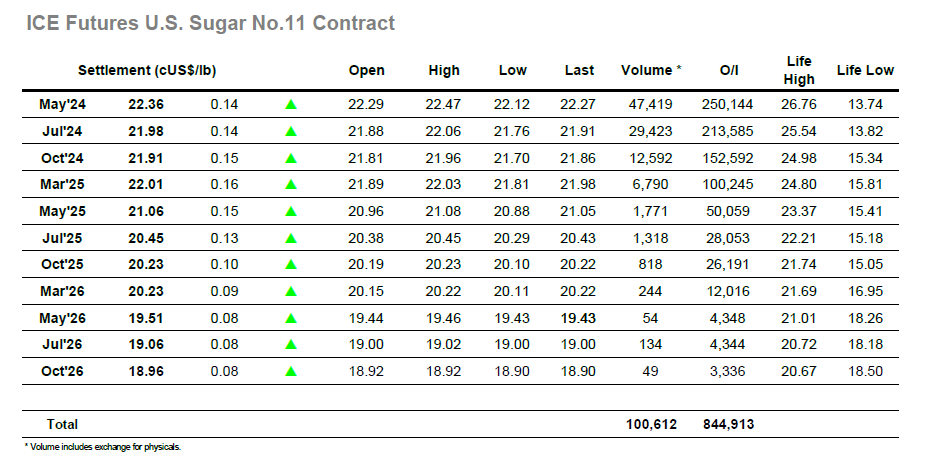

A mixed opening period provided the prelude to a morning rally which saw May’24 shake off this week’s weakness and return to sit calmly in the 22.40’s. Volumes were paltry through this period, and it seemed that the only salvation from a tedious session might be the arrival of some spec led inspiration in the US. The early afternoon did produce some additional movement but it was not of the nature to inspire interest from physical participants (either producer or consumer) as the price action simply chopped around within the morning range before returning to the earlier lows. With the upward progress having stalled there are now more questions being raised regarding the upside potential for the near term, and so another retreat to 22.12 was not wholly unexpected despite this week’s lows / the 22c area never being challenged. Instead, the market pushed back up into the range and continued to flit about against mostly day trader led volume, while others look on awaiting any developments of interest. With the close approaching May’24 was comfortably back in credit in the 22.30’s, and a calm end to the session saw it settling at 22.36 ahead of post close position squaring, leaving parameters unchanged.

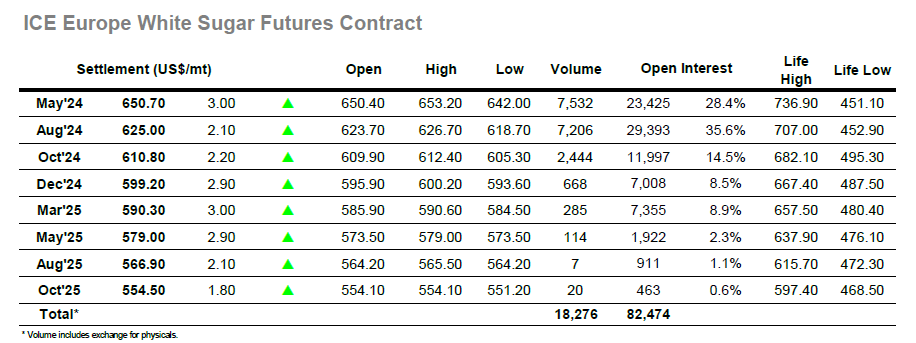

A huge $8 opening range for May’24 saw the price plunge from an initial $650.40 to $642.40, and with Aug’24 also dropping back to $618.70 the white premium values were instantly several dollars lower than last nights close. This setback could have had significant implications however the whites have proved extremely resilient of late and May’24 was soon making new session highs with the May/Aug’24 spread out to $28.50, while Aug’24 sat comfortably in the $622 area. Additional gains were recorded in late morning with Aug’24 climbing ahead to the mid $620’s, but while it is now attracting the bulk of the interest ahead of the May’24 expiry the activities were confined to small traders and lacked any real spark. Aug’24 topped out at $626.70 early in the afternoon and then flitted within the range amongst some long liquidation before mounting a fresh rally on which the daily high was matched. Spread volume was strong as pre-expiry rolling continues, May/Aug’24 seeing a range between $22.80/$28.50 and settling down toward the centre of this band during the later afternoon. Aug’24 ended the session at $625.00 to maintain a steady environment, while for the white premium values remain firm at $157.75 for May/May’24 and $140.40 for Aug/Jul’24.