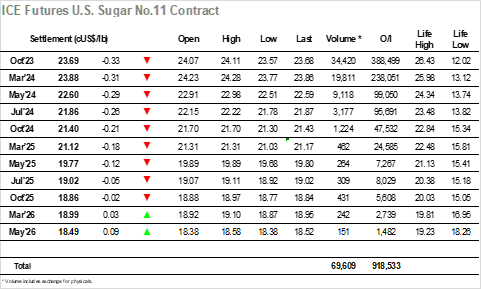

Opening buying saw Oct’23 trade up to 24.11 however the market quickly pulled back to slip back down through the recent range and sit in the 23.70’s ahead of yesterdays lows. Interest was muted with day traders showing a reluctance to get significantly involved having been swing around within the range of various occasion over recent sessions, thought some pressure was applied (stop hunting?) later in the morning which nudged prices through 23.71 to new lows for the current move. Slightly heavier selling appeared to test the support once the US day had commenced, taking Oct’23 down to 23.57 before the buying proved sufficient to prevent further losses and trigger the inevitable short covering rally. There was no desire to continue the move upward however and on continued low volume the market settled down to end the week tediously within the range. Spreads were as quiet as the outright with Oct’23/March’24 heading out at -0.19 points, while Oct’23 heads into the weekend with a weaker technical settlement level at 23.69.

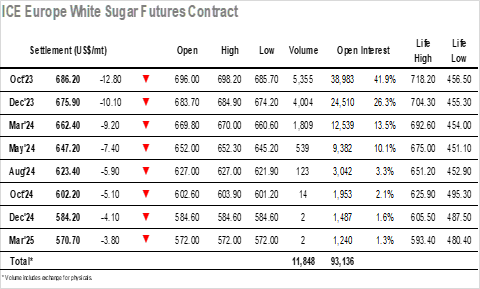

The whites have provided most of the positive momentum for sugar over recent days though there was no immediate sign of the supportive buying when we started today as Oct’23 fell quickly back down through the $690’s. This contrasted with the macro, though with No.11 again weaker and increased selling for the white premiums emerging after recent advances there was little the specs could do to fight the tide. Moving into the afternoon there was another leg down into the upper $680’s, taking the Oct/Oct’23 white premium further from its $172.00 high and towards the mid $160’s, and though a short covering bounce followed it had only limited impact upon this value. The struggle then resumed and the remainder of the session was spent crawling along at the bottom of the range, the limited selling preventing further losses with consumer buying remaining limited at current levels. There was a push down to new session lows on the close which left Oct’23 heading into the weekend at $686.20, providing potential for further near-term losses with support not seen until last weeks low mark at $676.80.