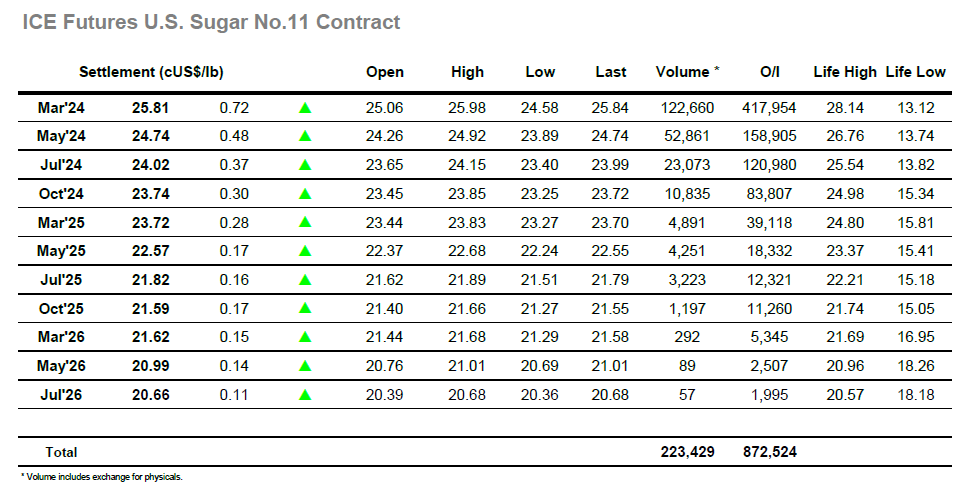

Today marked another day of extreme volatility, continuing the trend of the last several sessions. It’s the third consecutive day with trading volumes exceeding 100,000 lots. The market opened with a downward gap, extending the bearish trend from Thursday and Friday. In the first 30 minutes, the market sharply dropped 51 points, hitting a low of 24.58. However, by 10:06, it rallied back, recovering the initial loss. Between 10:06 and 12:08, prices fluctuated between 25.12 and 24.94. After 12:08, there was another rally, pushing prices to 25.40 by 12:30. At this point, the market encountered short-term resistance and a surge in sell orders at 13:08, causing a drop back to 25.00. Despite this, prices rallied once more, due to consistent buying, until facing resistance again at 26 cents. Overall, the day was marked by intense volatility, with a 140-point range between the highest and lowest prices. Following the previous settlement of 696.80, the price experienced a steady uptrend throughout the day. This was punctuated by a series of upward surges, of strong buying pressure. Particularly noteworthy is was the period between 12:00 and 13:30, where the market was propelled to an intraday high of 705 before collapsing $8 to 697. Following the downward spike the price then consolidated slightly, before continuing its upward momentum. The price action suggests strong appetite among buyers, given its consistent upward trajectory without significant pullbacks. The strong performance indicates that the bulls had control for the majority of the trading session.

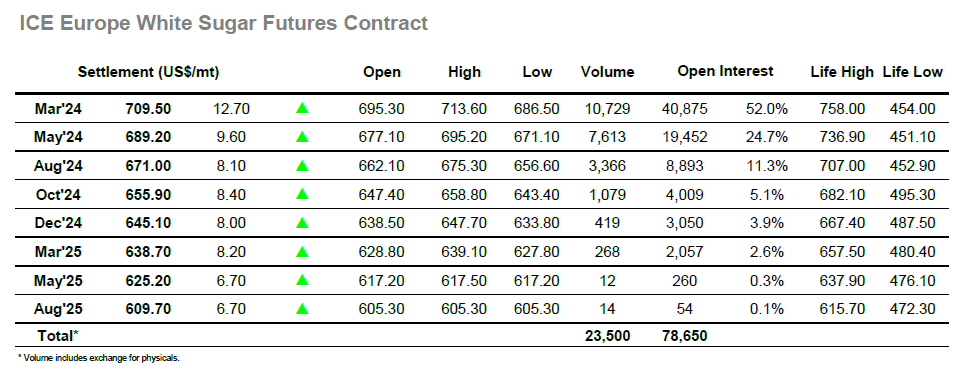

Following the previous settlement of 696.80, the price experienced a steady uptrend throughout the day. This was punctuated by a series of upward surges, of strong buying pressure. Particularly noteworthy is was the period between 12:00 and 13:30, where the market was propelled to an intraday high of 705 before collapsing $8 to 697. Following the downward spike the price then consolidated slightly, before continuing its upward momentum. The price action suggests strong appetite among buyers, given its consistent upward trajectory without significant pullbacks. The strong performance indicates that the bulls had control for the majority of the trading session.

Daily Market Price Updates and Commentary 4th December 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Dry Weather Aids EU Beet Plantings

Insight Focus European beet plantings are happening rapidly. They’ve...

Daily Market Price Updates and Commentary 11th April 2025

Raw Sugar Update It was with some relief that the market posted a calm...

Daily Market Price Updates and Commentary 10th April 2025

Raw Sugar Update After yesterdays close the news of the latest Tariff ...

CS Brazil: Sugar or Ethanol? 9th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 9th April 2025

Raw Sugar Update Following yesterday’s weak technical showing the ...

US Sugar Market Finds Some Support in Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...