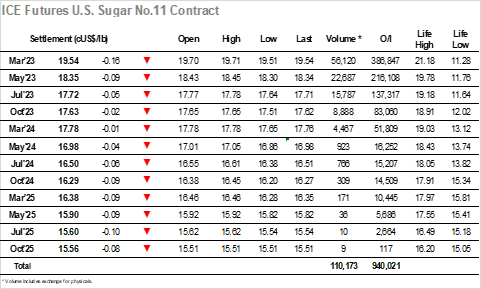

The day began in subdued fashion with the market nudging slightly lower, the movements stacking up relatively well when considered against the wider macro which was seeing losses for the energy sector. Volumes were incredibly light, and this enabled the market to consolidate with a decent volume of scale buying placed beneath 19.60 and no obvious spec liquidation seen we remained in a state of stalemate. The early afternoon saw a small element of volatility with the arrival of US specs into the fray however with the buying proving more robust than may have been expected this simply served to extend the range slightly into the 19.50’s rather than more significant change. Nearby spreads were narrower with March/May’23 back to the 1.20-point area, while the flat price became increasingly confined to a narrow range in the 19.50’s, the trade/consumer buying holding firm despite an ever-weakening macro which was bearing little influence. The resilience of the market to hold above 19.50 through until the close was quite impressive when compared to both white sugar and the wider macro, ensuring that a quiet closing period led to a settlement at 19.54. Whether this can stem the recent tide remains to be seen and a significant recovery remains unlikely at the present time, however it will at least provide some hope to long holders that the market is not done just yet.

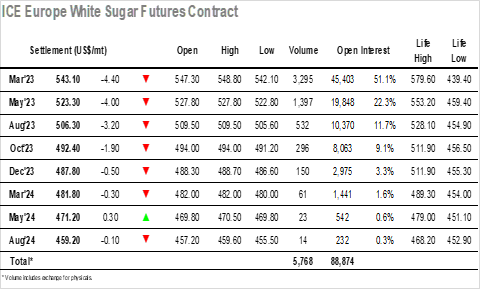

An unchanged opening soon gave way to some minor losses, although interest was light from both sides of the market meaning that it was hard to read much into the early activity. By late morning March’23 had pulled back to unchanged levels with support arriving via the spread with March/May’23 extending to $22.40, a solid showing when considered against a weaker macro environment. There was little change to the picture for the next few hours as prices continued to edge along against low volumes, however from mid-afternoon that was to change. Suddenly the macro concerns seemed to inspire some long liquidation into the market which resulted in new lows at the front of the board and a reversal of the earlier spread gains. By late afternoon, the March’23 contract had retreated all the way back to $542.10 with buyers rather thin on the ground, also pulling the white premium back down to $112.00 and erase all its daily gains. A mixed close did find some support from day trader position squaring to ensure a settlement just away from the lows at $543.10, though overall it was another poor showing that continues the weaker start to the year.