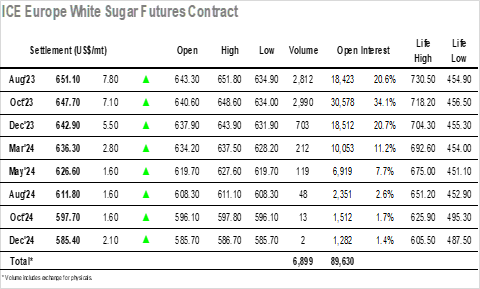

With No.11 closed for the Independence day holiday there was always likely to be a thin market environment, something that was immediately apparent as Oct’23 traded between $642.80 and $634.00 during the first few minutes of trading. Activity soon settled, and it was sellers that were dominating proceedings as they maintained Oct’23 in the mid to upper $630’s to leave losses showing through the morning with the spec buying that had pulled prices away from the recent lows over the past two sessions suddenly absent. This also impacted the spread values with Aug/Oct’23 trading back to parity and Oct/Dec’23 declining to $2.20 as the nearby prompts took the brunt of the selling. Generally, a US holiday will see prices gravitate back nearer to unchanged by the end of the session and an early afternoon recovery had all the hallmarks of such action with Oct’23 returning to the lower $640’s where a short period of consolidation ensued. On this occasion however there was more to follow and in a reversal of morning fortunes the market continued higher and by late afternoon the price had reached $646.30, a gain of more that $5. There was a further push higher from specs as we moved into the closing call which sent Oct’23 to a new high mark at $648.60, and with settlement made just below at $647.70 it will be interesting to see whether the No.11 follows suit and jumps higher again tomorrow morning.