The minutes saw May’24 holding a point above Fridays lows before pushing back above 21.00, and in slow conditions the morning then saw some stability with assorted consumer buying interest serving to push the market upward to hold a small credit. These gains extended to reach 21.33 for May’24 late in the morning, however the buying enthusiasm waned ahead of the US week getting underway with prices retreating towards unchanged levels. The 21c level held firm on the pullback and so the early afternoon saw prices looking to spring higher once again with fresh spec driven buying sending May’24 to new session highs at 21.43 to fuel hopes that the market may be trying to find a bottom, although these proved to be very short-lived. Long liquidation proved key to reversing this latest rally attempt and worse was to follow as the liquidation was followed by a few thousands lots more of selling when the market slumped to new recent lows with a break of 20.96. Initially there were efforts made to gather up the market from the lower 20.70’s, however with technical support sparse this side of 20c it proved difficult to gain much traction and so further lows were seen moving through the final hour. Spreads were also now weaker with the front of the board bearing the burden of the selling, and May/Jul’24 traded down to a daily low at 0.11 points from 0.24 points during the morning. An eventual low was recorded at 20.55 during the post close, and with settlement at 20.60 once feels there may be additional near-term weakness as specs continue to liquidate remaining longs / add new shorts.

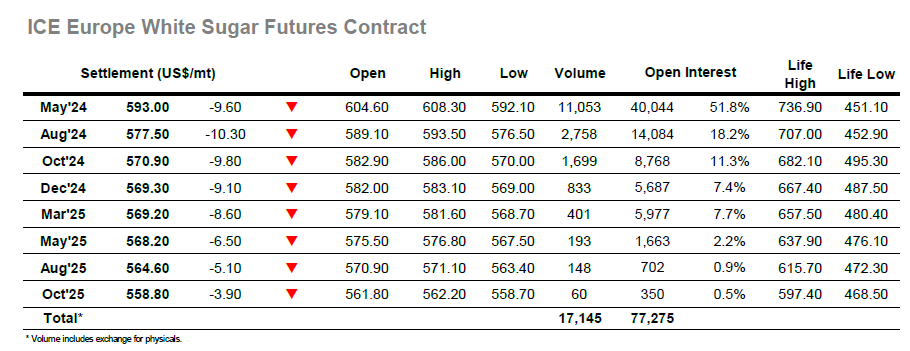

The new week commenced near to unchanged levels and while the recent fall had only drawn-out moderate buying it did prove sufficient to pull the market up by a few dollars across the first couple of hours. The gains were maintained until late morning, but the market then started to show some signs of struggle as the buying eased and long liquidation saw May’24 touch beneath $600.00. Unlike the past couple of sessions there was no collapse taking place and through into the afternoon efforts were made to re-gather the market and take prices back up into the range, though worryingly for the longs this effort was coming at a cost to the white premium with May/May’24 falling back down into the lower $130’s and suggesting a lack of wider support. The premium losses proved to be temporary though their recovery came at a cost to the flat price with the final two hours seeing values sink into the technical void below, just not at the same pace as the spec driven No.11 market. May’24 fell to $592.10 late in the session, and with limited support until the $570’s may yet see additional losses following a negative settlement value at $593.00. May/May’24 meanwhile ended the day back up its range at $138.00, though there will remain some worried longs as we head towards Tuesday following three successive poor performances.