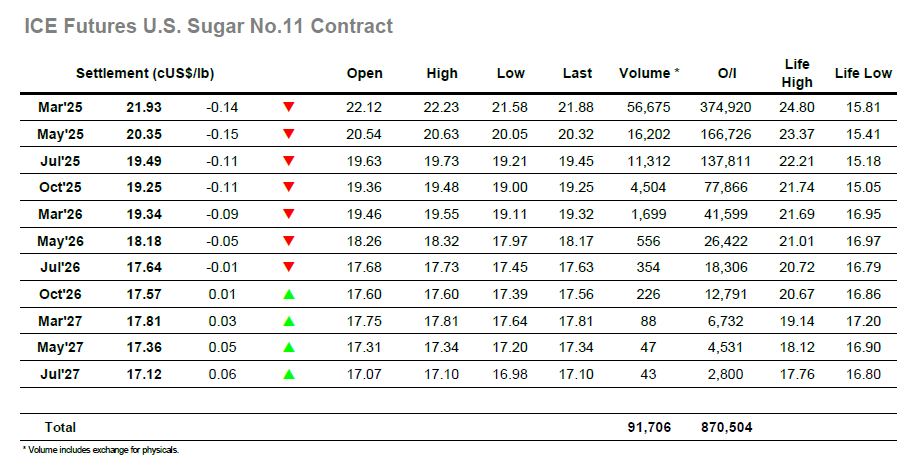

An initial push up to 22.23 could not sustain, and considering Fridays reversal the market was understandably lacking confidence. The 22c area was soon tested as the early buying dried up, and while the market found support in the 21.90’s before spending the rest of the morning hovering wither side of 22.00 the sentiment was feeling negative. Fridays COT report had shown that the specs are continuing to liquidate longs , with the long holding reduced by a further 11.000 lots to now stand at +19,926 lots. This liquidation suggests that the specs have resigned themselves to an extended stay within current parameters and are de-risking until a clearer signal is received, and the next market movement likely saw a continuation of this liquidation as March’25 crumbled to 21.58, a mere 3 points above the October low which provides initial support. That the market reacted positively and rebounded into the 21.90’s will bring encouragement to remaining longs considering the failure to rally on Thursday/Friday, but at best probably leaves the market continuing within the range for a while longer. The final hours played out quietly to leave march’25 settling at 21.93, changing nothing in terms of the overall picture though with the US election tomorrow and the result too close to call there will be hopes that macro reactions may lead to movement that our own fundamentals cannot currently provide.

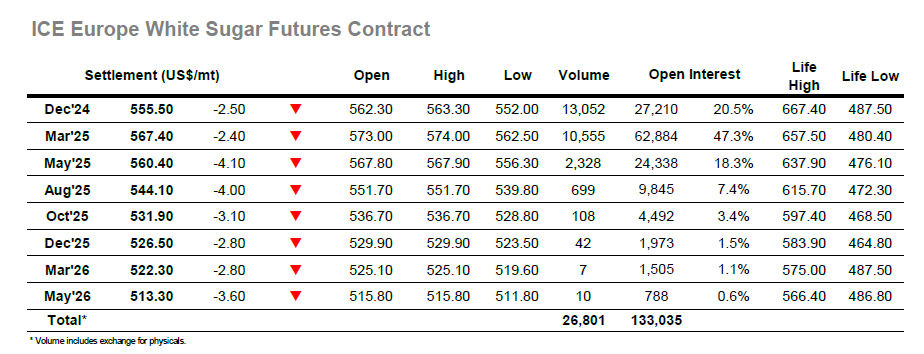

There was positive movement on the opening as the week began commenced with a push up to $574.00, though the early gains were likely driven by physical hedging and once this had concluded the price fell back to unchanged. Despite falling back on Friday, the market was finding some quiet support which enabled March’25 to pull back into the low $570’s across the later morning, settling things down to some familiar rangebound trading. The market busted out of its narrow band during the early afternoon as some fresh selling sent the price tumbling down to $562.50 and bring the 9th October low mark at $560.70 back into view before some short covering emerged and contributed towards a small recovery. Prices then levelled out and the rest of the session settled down to trade quietly in the mid/upper $560’s with interest waning. Against this backdrop of mostly dull trading there was steady volume for the Dec’24/March’25 spread (making up more than 60% of all activity across the front two prompts) with rolling continuing ahead of expiry and sending the spread lower to end the day at -$11.90. March’25 meanwhile limped along to a lower close of its own at $567.40 where we will resume with the lower end of the current range still in view.