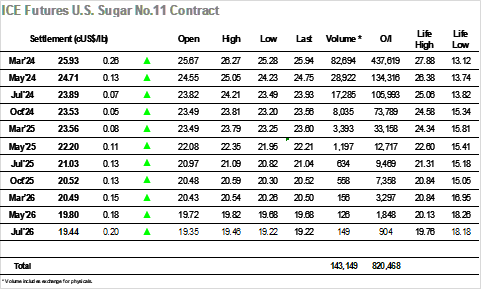

There was an immediate continuation of the recent corrective action this morning with selling hitting March’24 aggressively during the early stages to slip down to 25.28. Rather tan trigger additional liquidation these lower prices instead drew out some buying interest from consumers , which alongside day trader covering enabled the market to erase a good deal of the morning losses and sit comfortably in the 25.50’s throughout the rest of the morning. Despite lacking any significant fresh news there was a push higher during the early afternoon, driven by fund/spec/algo buying which sent the market soaring to recover a large chunk of recent losses. The movement was aided by a lack of volume on the short side with producers having only limited interest since falling back below 27.00, and so a high was recorded at 26.27, a whole 99 points above the early low, before cooling. With so few resting orders the market soon eased back beneath 26.00 and entered a consolidation phase, though as the afternoon progressed and with buyers not reappearing there was a further dip back to the 25.70’s. The final stages saw the price action hold near to 25.80, and though some end of day shenanigans meant a settlement at 25.93 there was little to suggest the market is yet ready to shake off its current lacklustre condition.

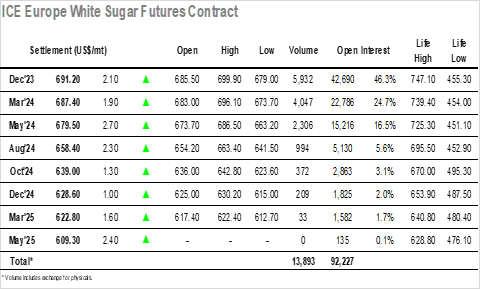

There was a spike lower on the opening in reaction to the losses being seen for No.11, with Dec’23 plunging down to $679.00 before an equally rapid recovery which left it sitting in the mid/upper $680’s. The movement was then somewhat more limited with the market settling down into a narrow range that held through the remainder of the morning, though whether it could be classed as stability considering recent movement is another matter. Trading remained calm through the early afternoon until a surge of spec buying from the US pulled values higher, a sharp move ending just shy of $700 at $699.90 and then retreating into the range as the buying dried up. There was more moderate consumer activity today with much still confined to scale orders, reflected in the volume which only attained respectable status due to some decent spread volumes. The rest of the afternoon saw a slow, gradual retreat towards the centre of the range, leading to a Dec’23 settlement at $691.20 while the aforementioned spreads closed at $3.80 for Dec’23/March’24 and $7.90 for March/May’24. White premiums were weak again through the day and March/March’24 settled at $115.75 having earlier nudged towards $114, movement which suggests the market is not yet ready to mount a sustainable recovery.