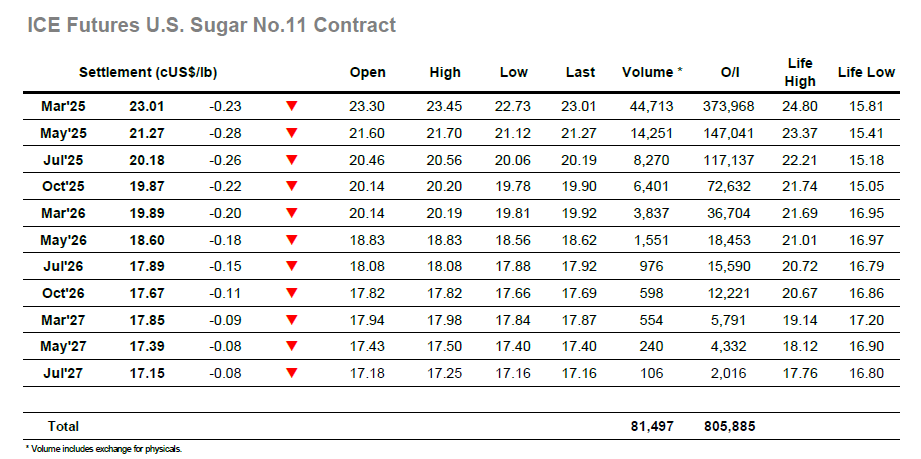

There was a mixed bag of activity during the early part of the session, though none of it carrying great substance, as the market traded in positive ground and extended its way up to 23.45. These highs did not sustain and across the later morning we saw values drop back to hold closer to overnight levels, trading water in hope that US specs may bolster the market following their arrival. Before the US day got underway there was a further decline back to the teens which reduced the upside impetus, and this in turn set the tone for a disappointing reversal. There was no drama as the price retreated with the movements proving very orderly, however across the following hours there was a return to 22.73 and the centre of this week’s trading band. Notably on the decline there was no sign of the nearby spreads weakening, with March/May’25 retaining the value that was gained yesterday, indicating that today’s movement was not being made against spec liquidation but was rather more influenced by a lack of buying meeting with some apathy. There was a token move away from the lows as the market played out the last of the week calmly, and while the usual MOC defence appeared to ping the price back up it served only to reduce the losses, though the settlement value at 23.01 may carry some minor psychological value.

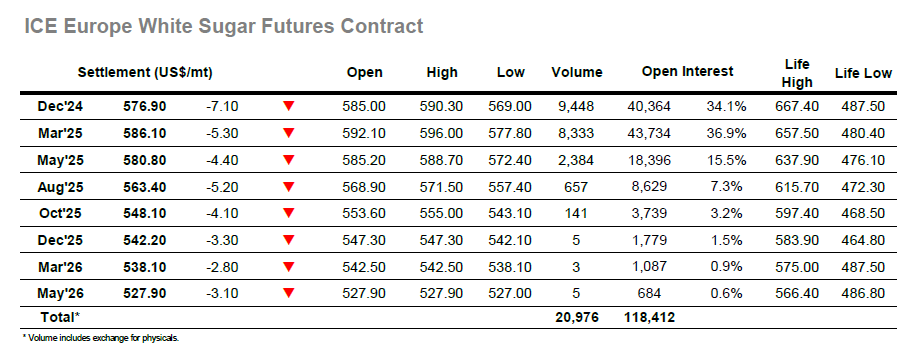

London whites started the day positively as early buying saw values moving upward with reasonable pace and widening the March/March’24 back towards $80. The higher levels were sustained through to late morning and the premium printed to $81, though by now the buying had waned and external factors from the sector saw prices track back down to session lows. Having weakened there was no sign of the necessary support required to halt the decline and so across the next few hours the market slipped steadily back to Dec’24 lows at $569.00, retracing much of yesterdays range and marking a fourth consecutive session on which the price has see-sawed within this band. The lack of support for Dec’24 remains tangible with the decline in spread values continuing, today seeing the Dec’24/March’25 value reach a -$9.40 discount. Recovering from the lows was initially quite rapid with some small trader covering seen, though the market then settled into a consolidation pattern and saw out the final two hours in the mid $570’s. Dec’24 settlement was made at $576.90 with the spread values just off the lows at -$9.20. March/March’25 gave back its early recovery, moving back down to end the week valued at $78.80.