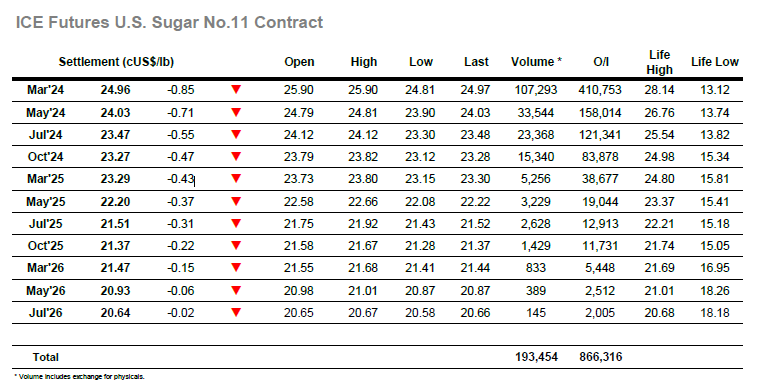

Recent volatility has come of something of a surprise to the bulls, though the relief from yesterday’s rally was palpable and there were many looking for the recovery to continue as we resumed. Early trading provided some encouragement with March’24 beginning the dat at 25.90, and while trading then shifted to be either side of overnight levels there was a calmer air to proceedings. By late morning, the lack of significant buying did allow for some drift in the flat price, by no means critical with the sell side similarly slow although the suggestion was that day traders were again eyeing up the short side as the more opportunistic path. This was confirmed during early afternoon with the arrival of the larger specs and funds seeing the sell side bolstered and soon bringing the 25c area back into focus. Consumer buying emerged in this area despite being well ahead of yesterdays low, slowing the pace of decline which eventually reached 24.81 before things calmed. Nearby spreads were narrower on the decline with March/May’24 back to 0.88 points intra-day, though the differential remains comfortably away from recent lows to provide some encouragement the fall may be nearing an end. Incredibly the 1.09-point range on show comfortably represents an inside day on the charts, and this remained the case with March’24 holding near to 25c through the later stages. The day ended with March’24 valued at 24.96, a poor showing though still away from the recent low.

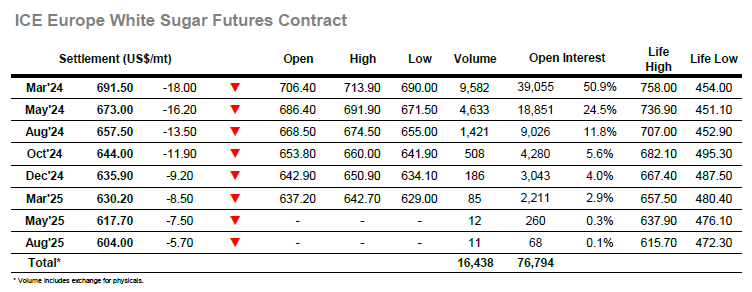

Recent sessions have provided a wild ride and despite a calmer start to today’s trading there remained questions as to how much we could build upon yesterday’s recovery with March’24 stalling in the lower teens. This led to a calmer morning, however by early afternoon it became apparent that this would not last as sellers once more emerged to put the market under pressure. With few resting orders above $700 the March’24 contract was falling rapidly as spec liquidation once again took the spotlight, and it was only when the price had slumped back to the lower $690’s that things eased up and some respite arrived. There was no fresh news, the movement simply a representation of how the speculative sector is dominating activity currently (as the faint-hearted stand aside), and while the downward movement came to a halt without challenging $686.50 the message was clear that the specs have fallen out of love with sugar for the moment. The final few hours were incredibly calm with prices comfortably tracking the lower part of the range and this may give some comfort to remaining longs that the market was no longer falling, though there will be more work to do in order to build a bottom. March’24 ended the day at $691.50 and tomorrow will be viewed with interest to see what more the specs may have in store.