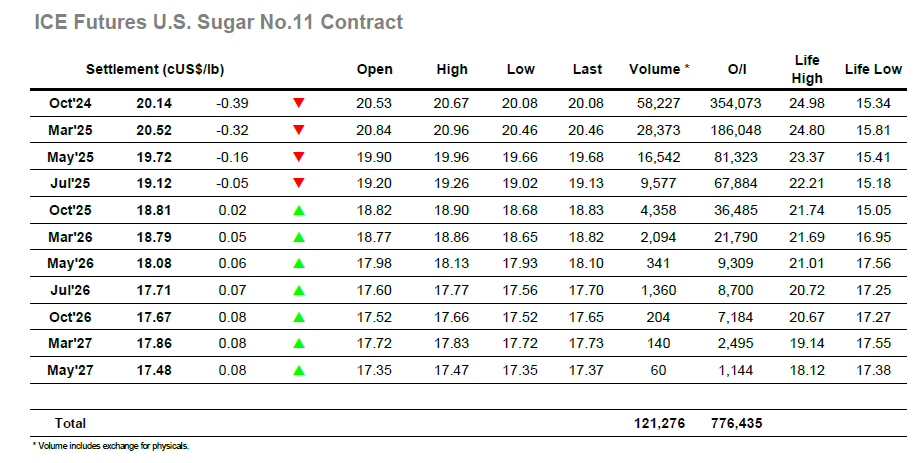

No.11 failed to follow the lead of white sugar during yesterday’s holiday with initially unchanged prints quickly giving way to losses which saw Oct’24 trade down to 20.34 before pulling back up to unchanged levels. A morning of quiet consolidation then ensued with the impetus of recent sessions lacking despite a nudge up to 20.67, meaning that any continuation of recent gains would again be reliant upon the US based specs. By the time that the US morning got underway the price had fallen back to the 20.50 area, and on low volume there was no sign of fresh participation to change the direction. Instead, prices started to work lower and gave back a little more of the recent gains, with damage also being inflicted onto the nearby spreads where Oct’24/March’25 was working back down to a -0.38 point discount. Through the later part of the afternoon, it was the low 20.20’s where support was located however this was broken heading into the call and a final burst of pre-weekend selling/position liquidation sent Oct’24 into the weekend at 20.14 and appearing less positive than had been the case earlier in the week.

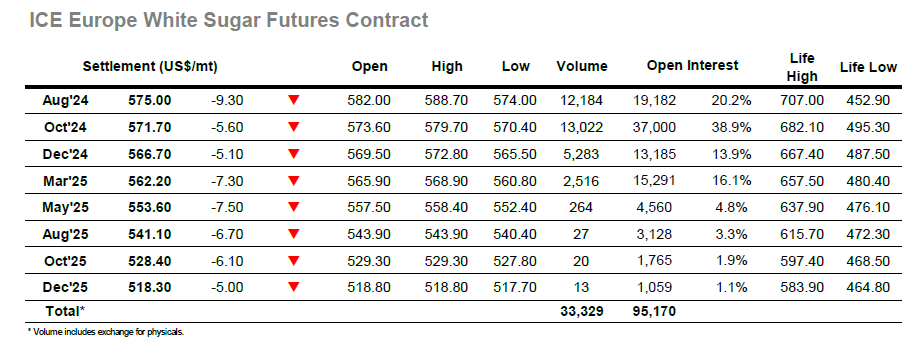

There was no support for No.11 to follow our own bounce from yesterday and so Oct’24 gapped lower on the intra-day chart with trades down to $571.80 on the call. Some buying did then follow in from consumers and specs as the market picked its way back towards unchanged, in the process widening out the Oct/Oct’24 white premium with the No.11 still trailing behind. As the flat price gathered momentum so the range extended up to $579.70, though unable to challenge yesterday’s highs some liquidation followed to leave prices tracking along in the $576.00 area. The whites continued to move calmly along within the lower end of the range as the afternoon developed, seemingly held back by a declining No.11 despite the Oct/Oct’24 arbitrage value extending beyond $127.00. Aug/Oct’24 spread activity was strong as the pre-expiry roll continues apace, and the differential was back under pressure this afternoon with lows at just $1.50 premium before ending the day at $3.30. Oct’24 meanwhile moved along calmly until the closing stages when pressure was allied to send it out at new lows, settling at $571.70 to take the shine off a previously impressive week.